That search for a "QuickBooks bookkeeper near me" is more than just another item on your to-do list—it's a real turning point for your business. It means you're shifting from just doing the work to strategically building something that can last.

Hiring a dedicated financial partner transforms bookkeeping from a nagging chore into one of your sharpest tools for making smart, real-time decisions.

Why Smart Businesses Search for a QuickBooks Bookkeeper

For so many Washington business owners, managing the books feels like a constant scramble. You’re putting out cash flow fires, squinting at confusing reports, and losing hours you could be spending with customers or dreaming up your next big move. It’s a reactive cycle that breeds uncertainty and holds you back.

Bringing in a professional QuickBooks bookkeeper completely flips the script. Instead of guessing, you get clarity. You finally have a partner who delivers accurate, up-to-date financials, giving you the confidence to actually steer your business instead of just hanging on for the ride.

From Necessary Chore to Strategic Advantage

A great bookkeeper does so much more than just categorize your expenses. They build an organized financial foundation that supports every single part of your business. That’s where the real magic happens.

Think of it this way: clean, reliable books are the bedrock of smart financial planning. With them, you can finally:

- Boost Your Bottom Line: Pinpoint which services are actually making you money and which ones are quietly draining your resources.

- Stay Audit-Ready: Keep meticulous records that take the stress out of tax season and keep you compliant with Washington State rules (hello, B&O taxes!).

- Make Data-Driven Decisions: Use solid reports to confidently invest in new gear, hire that next key employee, or expand your market.

- Secure Funding: Walk into a bank or investor meeting with professional financial statements that show you mean business.

This organized approach isn't just nice to have; it's essential. You can learn more about how smart bookkeeping transforms your business and helps you find those hidden profits.

The Power of Specialized Expertise

A skilled QuickBooks bookkeeper is your direct, responsive guide for all things financial. For small businesses—especially those with 1 to 20 employees and revenues between $100K and $2M—this kind of expertise is a total game-changer.

It’s no wonder 5.9 million businesses around the globe trust QuickBooks for their accounting. Cloud-based firms like Bugaboo Bookkeeping specialize in this world. We handle the nitty-gritty—transaction coding, bank reconciliations, payroll, and monthly reporting—all for a predictable fixed price.

The impact speaks for itself. A staggering 82% of small businesses that hire a professional bookkeeper report better cash flow within the very first year.

DIY Bookkeeping vs. Professional Service: A Reality Check

Many owners start out managing their own books, but it's worth taking a hard look at the true costs and benefits before you get too deep.

| Aspect | The DIY Reality | The Professional Advantage |

|---|---|---|

| Time Investment | 10-15 hours per month spent on data entry, reconciliation, and troubleshooting—time taken from growing your business. | Your time is freed up. We handle the numbers so you can focus on your clients, team, and vision. |

| Accuracy & Risk | Higher chance of costly errors, missed deductions, and compliance issues. One mistake can lead to IRS penalties or bad decisions. | Expert oversight ensures accuracy, compliance with tax laws, and audit-ready books, minimizing financial risk. |

| Financial Insight | Basic reports show where money went. It's often hard to see the "why" or spot future trends. | You get clear, actionable financial reports (P&L, Balance Sheet) that tell a story and guide strategic planning. |

| Tools & Tech | Juggling software subscriptions and trying to integrate tools can be a clunky, expensive headache. | We use a professional tech stack and optimized workflows, giving you access to better tools without the direct cost. |

| Stress Level | Tax deadlines loom, cash flow is a constant worry, and you're never 100% sure if you're doing it right. | Peace of mind. You have a dedicated partner to answer questions and ensure your financial house is always in order. |

At the end of the day, handing off your books isn't just about saving time. It's an investment in clarity, accuracy, and the peace of mind you need to lead your business effectively.

Figure Out Exactly What You Need a Bookkeeper For

Before you even start searching for a "QuickBooks bookkeeper near me," you have to know what you’re actually looking for. It’s like going to the mechanic and saying, "My car's acting funny." You’ll get much better results if you can point to the specific problem.

The goal isn't to become a bookkeeping pro overnight. It’s about taking a hard look at your business and making a simple checklist of what needs to get done. This simple step will save you from paying for services you don't need or, even worse, hiring someone who can't handle what makes your business unique.

The Everyday Stuff: Core Bookkeeping Needs

Every business, no matter the industry, has a set of core financial tasks that just have to get done. These are the non-negotiables that keep things running. Take a look at your own operations—do you need help with these essentials?

- Daily Transaction Coding: Making sure every single dollar that comes in or goes out is put in the right category.

- Bank and Credit Card Reconciliations: The monthly chore of confirming your QuickBooks Online numbers match your bank statements exactly.

- Accounts Payable (A/P): Staying on top of bills and paying vendors on time to keep those relationships strong.

- Accounts Receivable (A/R): Sending invoices and, crucially, following up to make sure you actually get paid.

These tasks are the foundation of accurate books. If this is all new to you, checking out some bookkeeping basics for small business is a great way to get your bearings.

Beyond the Basics: Finding Specialized Support

Chances are, your needs go a bit deeper than just the fundamentals. This is where you start to see the difference between a general bookkeeper and a true specialist who gets your industry and knows the local rules.

Think about it: a Seattle-based consulting firm needs to track profitability on every single client project (that’s job costing). On the other hand, a manufacturing business over in Aberdeen is going to be far more concerned with inventory tracking to manage stock and the cost of goods sold. They’re completely different worlds.

My Two Cents: Taking the time to map out your specific needs is the single most important thing you can do. It’s how you make sure you’re judging candidates on the skills that will actually move the needle for your business.

Building Your Personal Service Checklist

Alright, let's put together your custom checklist. Think about your day-to-day grind, your team, and what keeps you up at night financially. Does your business need a hand with any of these?

- Payroll: This is a big one. Managing paychecks, withholdings, and direct deposits is usually one of the first things owners are thrilled to hand off.

- Washington State B&O Tax Filings: If you do business in Washington, you know about our unique B&O tax. You need someone who knows these rules inside and out—it's not optional.

- Job Costing & Project Tracking: Essential for contractors, agencies, and anyone who needs to know if individual jobs are making or losing money.

- Inventory Management: A must for any business selling physical products. Bad inventory management can sink a company.

Now, think about any big, messy projects on your plate. These often require a very specific skillset that not every bookkeeper has.

For instance, are you staring at months (or years!) of messy books? That’s called catch-up or clean-up work, and it's a special project to get your financials back on track. Or maybe you've gotten into crypto and now you need crypto tax support—a highly specialized area that involves tracking transactions across different wallets and exchanges for the IRS.

When you have this detailed list in hand, your search stops being a shot in the dark. You're not just looking for any bookkeeper; you're looking for your bookkeeper.

How to Find—and Truly Vet—Your QuickBooks Pro

Alright, you've got your personalized checklist. Now, let's move past the "hope for the best" strategy. The real work begins when you sift through that long list from your "QuickBooks bookkeeper near me" search to find a genuine specialist.

The goal isn't just to find a bookkeeper; it's to find the right bookkeeper. You need someone whose expertise is a perfect match for your business, whether you're running a tech startup in Bellevue or a contracting business in Spokane.

Let’s dig into where to look and, more importantly, what to ask to see who really knows their stuff.

Start Your Search in the Right Places

A quick Google search is fine for casting a wide net, but to find high-caliber talent, you need to fish in the right ponds. Going straight to where the pros gather saves you from wading through a sea of unqualified candidates.

Here are the most reliable places to start your hunt:

- The QuickBooks ProAdvisor Directory: This should be your first stop. It's Intuit's official list of professionals who have passed certification exams, proving they know the software inside and out. You can filter by location, industry, and specific services like payroll or tax prep.

- Your CPA or Tax Preparer: Your accountant has a huge stake in the quality of your books. After all, clean records make their job easier. They often have a trusted network of bookkeepers they’ve worked with and can confidently recommend.

- Local Business Networks: Never underestimate a solid referral. Ask other business owners in your local Chamber of Commerce or industry group who they use. A recommendation from a fellow entrepreneur who understands your challenges is often pure gold.

The Pre-Screening Checklist: Vetting Before You Call

Before you even pick up the phone, a little bit of homework can save you a ton of time. This initial screening helps you weed out the obvious non-starters and focus your energy on the most promising candidates.

Here’s what to confirm before scheduling a meeting:

- QuickBooks Online ProAdvisor Certification: This is non-negotiable. It proves they have a foundational mastery of the platform. You can (and should) verify their certification status directly on the ProAdvisor directory.

- Washington State Expertise: They need to show they have real-world experience with our state's unique compliance rules, especially Washington B&O and sales tax. A good follow-up question is asking how they manage this for their other local clients.

- Proven Industry Experience: Find someone who already speaks your language. A bookkeeper who specializes in e-commerce won't necessarily understand the trust accounting needs of a law firm.

- A Clear Online Presence: A professional website, client testimonials, and transparent service descriptions are all green flags. It shows they're an established business that takes itself seriously.

Why is this so critical? Because with QuickBooks holding a staggering 62.23% market share, its popularity is immense. About 62% of its users are small businesses just like yours. This means a lot of people claim to be QuickBooks experts, but only a fraction are true, certified professionals.

Smart Questions to Ask During the Consultation

Once you have a shortlist, the consultation is where you separate the contenders from the pretenders. You’re not just hiring a number-cruncher; you’re looking for a long-term financial partner.

Key Takeaway: The best bookkeepers are proactive communicators who make your financial life easier, not just people who categorize transactions. Your questions should uncover their partnership style, not just their technical abilities.

Think of this as a two-way street. While you’re interviewing them, a great bookkeeper will also be asking you questions to make sure they can genuinely help your business succeed.

Here are some insightful questions to get the conversation rolling:

- Process and Workflow: "Can you walk me through your typical month-end close process for a client like me? What do you need from my team, and what are the key deadlines we'd be working with?"

- Communication Style: "When questions come up, what’s your standard response time? Will I have a single point of contact, or will I be working with a team?"

- Tech and Tools: "Beyond QuickBooks, what other software do you use for things like receipt management or reporting?" For example, knowing how they efficiently import transactions into QuickBooks Online says a lot about their workflow and efficiency.

- Reporting and Insights: "What kind of financial reports do you provide each month? More importantly, how do you help clients understand what the numbers actually mean for their business strategy?"

- Problem Solving: "Tell me about a time you took on a new client and discovered a major issue in their books. What was the problem, and how did you approach fixing it?"

Listen closely to their answers. A confident, experienced professional won't hesitate. Their responses will tell you everything you need to know about their expertise, their process, and whether they're the right fit for you.

Decoding Bookkeeping Prices in Washington State

Let’s get right to it—the question every business owner asks: "How much is this going to cost?" When you're searching for a "QuickBooks bookkeeper near me," you aren't just looking for help. You're making a serious investment in your company's financial future. Understanding the price tag is one thing, but seeing the real value behind it is what truly matters.

Here in Washington State, there’s no single, off-the-shelf price for bookkeeping. The final cost really boils down to three things: the pricing model, how complex your business is, and exactly what services you need.

Let's unpack what you should expect so you can budget with confidence.

The Big Problem with Paying by the Hour

The oldest pricing model in the book is the hourly rate. On the surface, it seems simple enough—you pay for the time someone spends on your books. The problem is, this model has some major downsides for you, the business owner.

Hourly billing creates an awkward conflict of interest. Your bookkeeper gets paid more for taking longer, while you obviously want the work done as efficiently as possible. This setup almost always leads to unpredictable monthly bills that can completely derail your budget. One month you might pay for five hours, but the next, a small hiccup could double your bill to ten hours without any warning. It’s a recipe for financial anxiety.

A Better Way Forward: Predictability is power. When you know exactly what your bookkeeping will cost each month, you can budget effectively and focus on growing your business, not on clock-watching your financial partner.

Why Fixed Monthly Pricing is the Modern Standard

This is exactly why modern, forward-thinking firms, including Bugaboo Bookkeeping, have embraced a fixed monthly pricing model. With this approach, you pay one predictable fee every month for a clearly defined scope of work. No surprises. No hidden fees. No watching the clock.

This model completely changes the dynamic. Instead of being incentivized by time, our goals become perfectly aligned with yours: making your bookkeeping as efficient and accurate as possible. We invest in better technology and smarter workflows because it benefits everyone. You get the peace of mind that comes with a stable, predictable expense, and we can focus on delivering exceptional value.

What to Expect for Bookkeeping and Payroll in Washington

For established small businesses in Washington with annual revenues between $100K and $2M, a comprehensive bookkeeping service is a strategic investment. The exact price will depend on a few key factors:

- Transaction Volume: How many transactions are flowing through your bank and credit card accounts each month?

- Number of Accounts: Are we reconciling one bank account and one credit card, or several of each, plus loans?

- Payroll Complexity: How many people are on your team, and how often do you pay them?

- Compliance Needs: Do you need help managing Washington's unique B&O and sales taxes? Navigating these local rules is a huge part of the value. For a deeper dive, check out our guide on Washington State small business taxes.

A full-service monthly package covering both core bookkeeping and payroll management will fall into a specific range based on those variables. Think of it less as a cost and more as an investment that pays for itself in saved time, fewer headaches, and smarter financial decisions.

Pricing for Special Projects

So, what about those bigger, one-off jobs? Things like getting hopelessly messy books back in order or tackling complex tax situations are usually priced separately.

Here’s a quick look at how these projects are typically handled:

- Catch-Up and Clean-Up Work: If your books are months (or even years) behind, we treat this as a one-time project. We’ll first assess the scope of the mess to figure out what it will take to get you current and compliant. Then, we provide a fixed-price quote for the entire project. This gives you a clear path to a fresh start without an open-ended hourly bill looming over you.

- Crypto Tax Preparation: This is a highly specialized service that requires serious expertise. Preparing an accurate IRS Form 8949 means meticulously tracking every single transaction across multiple exchanges and wallets. This work is also quoted as a separate, fixed-fee project based on the volume and complexity of your crypto activity.

By separating these special projects, we keep your ongoing monthly bookkeeping fees predictable and fair. You only pay for these intensive, one-time services when you actually need them. This approach helps you see bookkeeping not as a drain on your resources, but as a strategic investment in your company's stability and growth.

What to Expect During the Onboarding Process

You’ve done the hard work of vetting candidates, figuring out the pricing, and finally picking the perfect QuickBooks bookkeeper for your business. Signing that proposal feels like a huge win, but what actually happens next? A smooth, well-organized onboarding process is the hallmark of a true professional and lays the groundwork for a solid partnership.

This initial phase usually takes the first 30 to 60 days. It’s all about discovery, setup, and getting into a good groove. This is when your new financial partner goes from being an outsider to an integrated part of your team. Let's pull back the curtain on what you should expect during this critical time.

The First Steps to Getting Started

The moment you sign that engagement letter, the gears start turning. This isn’t just a matter of handing over your passwords; it’s a methodical transition built to be secure and efficient.

Things usually kick off with a structured welcome call or meeting. This is where you’ll nail down the communication plan—who your main point of contact is, the best way to ask quick questions, and when to expect regular updates. From there, you'll securely provide access to your key financial accounts. This typically includes:

- QuickBooks Online: You'll grant "Accountant" level access. This gives your bookkeeper the tools they need without handing over ownership of your file.

- Bank and Credit Card Feeds: They’ll help you connect your business accounts using secure, read-only access so they can see transactions as they post.

- Payroll Systems: If they're handling payroll, you’ll provide access to your existing provider to make sure the transition is seamless for your team.

A Pro Tip: Before you get to this stage, it's a great idea to get your historical data in order. If you have past records piled up in spreadsheets, for example, a clean file makes everything go so much smoother. You can find some practical advice on uploading Excel data into QuickBooks to get a head start.

Diving Deep During the Discovery Phase

Once they have access, your bookkeeper starts the crucial "discovery and clean-up" phase. Think of them as an archaeologist for your business's financial history. They’ll be digging through past transactions, reviewing your existing chart of accounts, and getting a real feel for your cash flow patterns.

This isn’t just about catching mistakes. It's about understanding the story your numbers tell. During this phase, a good bookkeeper might spot opportunities to categorize expenses better or suggest ways to improve your day-to-day financial workflows. If any catch-up work is on the table, this is when it gets done, bringing your books up to date and giving you a clean slate.

The accounting world is growing fast, and this kind of meticulous onboarding is becoming the standard. The global market is projected to hit $735.94 billion by 2025, and professionals are relying on platforms like QuickBooks to be more accurate and efficient. This modern approach leads to 43% easier onboarding and 40% higher client satisfaction, ensuring you get real value right from the start.

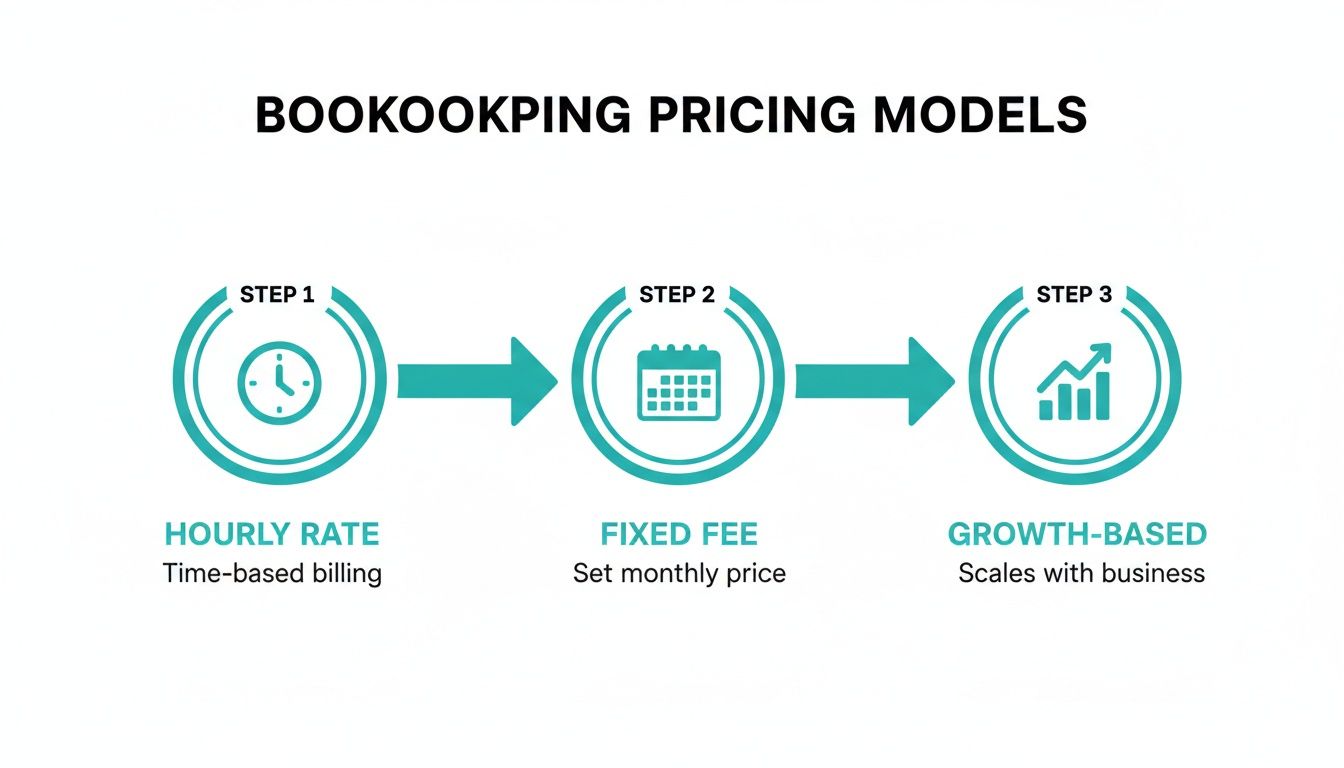

This visual shows the industry's shift away from unpredictable hourly rates toward the stability of fixed-fee and growth-focused pricing.

You can see the clear trend toward fixed pricing, which is all about providing predictable value. That value starts with a transparent, no-surprises onboarding process.

Establishing Your Monthly Rhythm

By the end of the first month or so, the clean-up work should be wrapped up, and your ongoing monthly process will start to take shape. This is where you'll really begin to feel the benefit of having a pro in your corner.

You’ll settle into a predictable cycle. This means knowing when to submit any necessary documents, getting your questions answered promptly, and receiving your monthly financial reports on a set schedule. This consistent rhythm takes the guesswork out of your finances and gives you the confidence to make smart decisions, knowing your books are accurate and always up-to-date.

Answering Your Top Questions About Hiring a Bookkeeper

Deciding to bring in a professional bookkeeper is a big move. It’s totally normal to have a few questions before you hand over the reins. After all, you’re not just outsourcing a task; you’re trusting a critical part of your business to a new partner.

Let's walk through some of the most common questions and concerns I hear from business owners. My goal is to give you clear, practical answers so you can move forward with total confidence.

How Much Should I Expect to Pay a Bookkeeper in Washington?

We touched on pricing models earlier, but let's get down to brass tacks. For a small business here in Washington State, there's no single price tag for professional bookkeeping. The cost is really tailored to the complexity and volume of your financial activity.

A flat monthly fee has become the gold standard, and for good reason—it gives you a predictable number to plug into your budget. For most businesses with revenue between $100K and $2M, you can expect those fees to range from a few hundred to over a thousand dollars per month.

To give you a better feel, here are a couple of real-world scenarios:

- The Service Business: Picture a Seattle-based marketing consultant with three employees. They need monthly bank reconciliations, payroll processing, and B&O tax filing. With a moderate number of transactions, their monthly fee would likely land on the lower end of that range.

- The Retailer: Now, think about a retailer in Aberdeen with ten employees. They’re managing a large inventory, processing hundreds of sales every day, and navigating complex sales tax rules. Their needs are much more intensive, which would put their monthly fee at the higher end.

The main drivers are always transaction volume, the number of employees on payroll, and any special services like inventory management. This fixed-fee structure ensures you get precisely the support you need without any surprise bills.

What Is the Difference Between a Bookkeeper and a CPA?

This is a fantastic and absolutely crucial question. Getting the roles of a bookkeeper and a Certified Public Accountant (CPA) straight is key to building a smart financial team. They aren’t interchangeable—they’re two essential parts of the same whole.

Think of it like building a house.

Your bookkeeper is the master builder on-site every day, laying a perfect foundation. They meticulously record every transaction, reconcile all your accounts, manage payroll, and make sure the entire structure is solid and accurate. Their job is to create a flawless set of books that reflects your day-to-day financial reality.

Your CPA is the architect and the inspector. They take that solid foundation your bookkeeper built and use it for high-level tax planning, strategic advice, and official filings. They’ll prepare your income tax returns, perform audits if needed, and help you map out major financial decisions for the future.

A great bookkeeper makes your CPA’s job faster, easier, and much more cost-effective. When your CPA gets pristine, organized books, they can dive right into high-value strategy instead of billing you for expensive hours spent cleaning up messy records.

My Books Are a Complete Mess. Can This Be Fixed?

I hear this a lot, often from business owners who are completely stressed out. The simple, reassuring answer is: yes, absolutely. No matter how tangled or neglected your records are, a skilled bookkeeper can get them sorted out.

We call this process catch-up or clean-up bookkeeping. It’s handled as a separate, one-time project before your regular monthly service begins.

An expert will dive into your past records, untangling months or even years of disorganized transactions. They’ll categorize everything correctly, reconcile old accounts, and piece your financial story back together to produce accurate, tax-ready financial statements. It’s a detailed process that brings immense relief and gives you a clean slate. You'd be surprised how quickly a dedicated pro can bring order to the chaos.

Do I Really Need a Bookkeeper Who Is Physically Near Me?

Searching for a "QuickBooks bookkeeper near me" is a smart instinct, but maybe not for the reason you think. These days, physical proximity is no longer a requirement for excellent service. The 'near me' factor is really about local expertise, not a shared zip code.

Modern, cloud-based firms use tools like QuickBooks Online, secure document portals, and video calls to provide seamless, real-time support to clients anywhere. You get the same personal connection and responsiveness you would with someone down the street, but with way more flexibility.

What truly matters is finding a bookkeeper who has deep, proven expertise in Washington State's unique financial landscape. They must understand the nuances of our B&O tax, specific sales tax regulations, and state payroll laws.

Hiring a remote, Washington-based firm gives you the best of both worlds: the convenience of digital collaboration and the critical local knowledge that keeps your business compliant and thriving.

Ready to get the clarity and peace of mind your business deserves? Bugaboo Bookkeeping offers expert, cloud-based bookkeeping and payroll services tailored for Washington State businesses. Schedule your free consultation today to see how we can help you thrive.