Let's be honest: trying to track your crypto taxes with a spreadsheet is a thing of the past. The days of simply noting a few Bitcoin buys and sells are long gone. With the explosion of DeFi, NFTs, and staking, using specialized software isn't just a convenience—it's a necessity. It’s the only practical way to get your cost basis right, catch every single taxable event, and generate the IRS-compliant reports you need, like Form 8949. This is how you avoid audit headaches and save yourself from hours of tedious, error-prone work.

Why Manual Crypto Tax Reporting Is No Longer an Option

If you're still using a spreadsheet to track your crypto, you're playing with fire. The modern crypto ecosystem is a tangled web of transactions spread across dozens of exchanges, wallets, and blockchains. Trying to track all that by hand is a recipe for disaster.

Think about it. Every crypto-to-crypto swap, NFT flip, staking reward, and airdrop is a taxable event. Manually figuring out the cost basis and the resulting capital gain or loss for potentially thousands of transactions is a monumental task. One slip-up can throw everything off.

The Risks of a DIY Approach

Going it alone with manual tracking opens you up to some serious risks that could lead to big mistakes and unwanted attention from the IRS. Without a proper system, you're likely to run into:

- Inaccurate Cost Basis: Getting the original purchase price of an asset wrong is the fastest way to miscalculate your capital gains and, ultimately, your tax bill.

- Missed Taxable Events: It’s easy to forget about reporting income from staking, providing liquidity, or even using crypto to buy something. These omissions can lead to underpayment and penalties.

- Lack of an Audit Trail: If the IRS ever comes knocking, a simple spreadsheet won't cut it. You need a verifiable, chronological record of your entire transaction history.

This growing complexity is exactly why investors are turning to crypto tax software in droves. The global market for these tools is valued at USD 210.6 million in 2025 and is projected to explode to USD 683.9 million by 2035—that's a compound annual growth rate (CAGR) of 12.5%. This growth isn't just a trend; it's a direct response from investors who need reliable solutions to navigate complex tax rules.

At its core, crypto tax software exists to turn a chaotic mess of transaction data into a clean, compliant, and audit-ready report. It does the heavy lifting of data collection and calculation so you can meet your tax obligations without the stress.

The Clear Need for Automation

Good crypto tax software connects directly to your exchanges and wallets through APIs or public addresses, pulling in your entire transaction history automatically. This is where the magic happens. These platforms are built to understand and correctly classify tricky activities like DeFi lending or NFT minting, things that are nearly impossible to sort out by hand.

By using these tools, you ensure every detail is captured—from transaction fees to gas costs—to generate a pinpoint-accurate Form 8949. If you need a hand navigating this, our guide on professional bookkeeping and crypto tax preparation can point you in the right direction.

How to Judge Crypto Tax Software

Before you even start comparing different crypto tax software, you need to know what you're looking for. It's easy to get distracted by flashy features, but the best tool is simply the one that fits your specific crypto activity. Not all platforms are built the same.

Think of it like building a checklist. A slick-looking dashboard is nice, but it's worthless if the software can't import data from the exchange where you do most of your trading. Likewise, a cheap subscription doesn't help if it can't handle DeFi or NFT transactions, leaving you to untangle a mess of transactions by hand.

The Must-Have Features

At its core, any decent crypto tax tool has to pull in your financial data automatically and accurately. If you have more than a handful of trades, manual entry is completely out of the question. That’s why solid integrations are the absolute baseline.

Start your search by focusing on these essentials:

- API and Wallet Connections: The software has to connect flawlessly with the exchanges, wallets, and blockchains you actually use. Look for strong API support for the big players like Coinbase and Binance, plus direct syncing for wallets on chains like Ethereum and Solana.

- Handling Complex Transactions: Crypto isn't just buying and selling anymore. A good tool needs to correctly identify and sort transactions from DeFi lending, NFT mints, staking rewards, and airdrops.

- Flexible Cost Basis Methods: The IRS gives you options for how you calculate your gains, like First-In, First-Out (FIFO) or Highest-In, First-Out (HIFO). The software you choose should support these different methods so you can legally reduce what you owe.

Without these key pieces, a crypto tax platform is really just a fancy spreadsheet. These features make sure the data is complete and correct from the very beginning.

Reporting and Ease of Use

Once all your data is imported, the software needs to turn that raw information into clean, compliant tax reports. This is where you really see the value. A great platform here saves you a ton of time and stress when tax season rolls around.

Here’s what to look for on the reporting side:

- IRS Form Generation: The single most important output is a ready-to-file IRS Form 8949. This form lists out every capital gain and loss. The best software creates one that you can hand directly to your CPA or import into tax software like TurboTax.

- A Painless Reconciliation Process: Let's be honest—no software is perfect. You'll always have a few transactions that need a second look, like a weird DeFi protocol interaction that the system didn't recognize. A good user interface lets you find, edit, and fix these outliers without wanting to pull your hair out.

- Clear Portfolio Tracking: The best platforms do more than just taxes. They give you a real-time snapshot of your entire crypto portfolio, including your profit and loss. This is crucial for making smart investment decisions throughout the year.

The real test of any crypto tax software is how it handles the weird stuff. A platform's ability to correctly classify a niche DeFi transaction or a complex NFT sale is what separates a basic calculator from a tool you can actually rely on.

In the end, the goal is a complete and accurate financial picture—not just for the IRS, but for your own financial planning. For a business, this level of detail is even more critical. Learning how to track every business expense accurately is the bedrock of good financial management. With this framework, you can confidently figure out which tool will give you the accuracy and efficiency you need.

A Head-to-Head Crypto Tax Software Comparison

With the groundwork laid, let's dive into how the top crypto tax software platforms actually perform. This isn't just a feature checklist; it's a real-world stress test to see how Koinly, CoinLedger, and TokenTax handle the messy reality of a diverse crypto portfolio. We'll also touch on TaxBit to clarify its current role in the market.

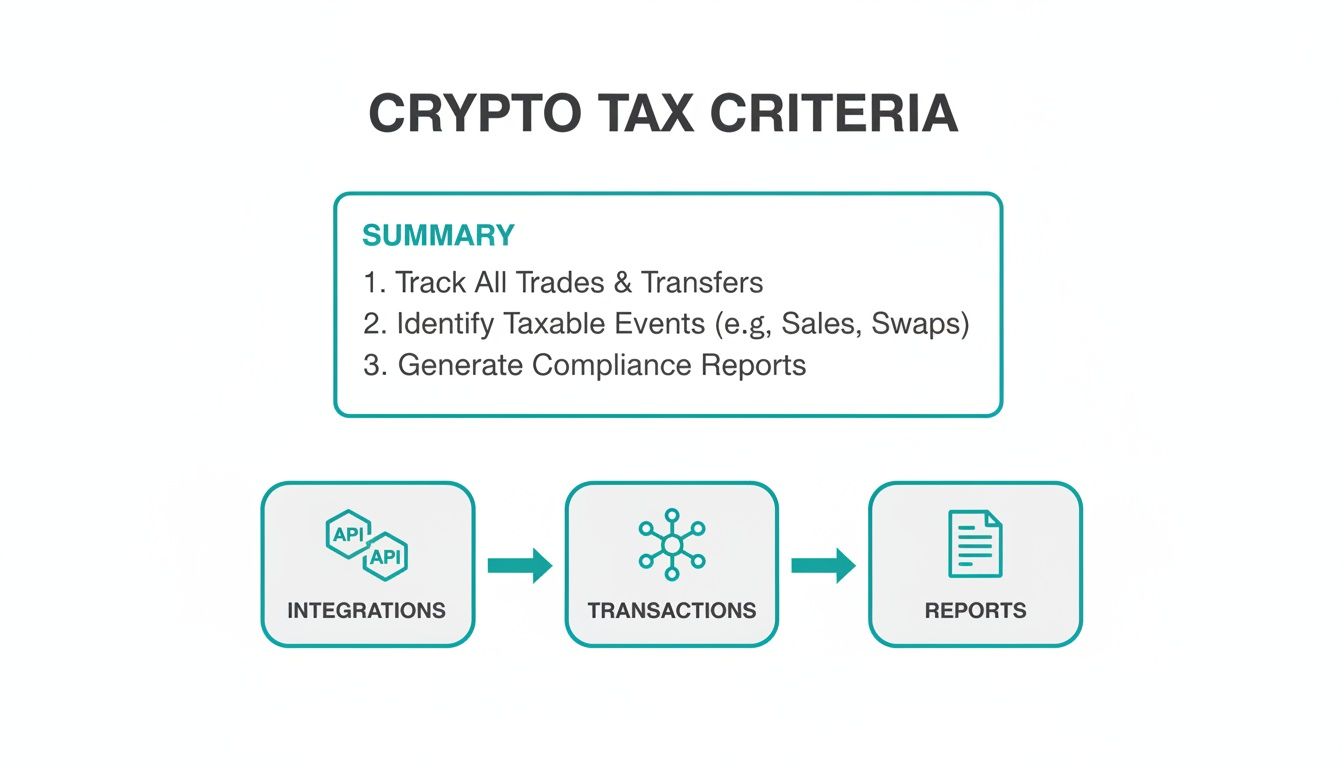

This diagram lays out the core workflow every crypto investor goes through, from gathering data to filing the final reports.

It’s a great visual reminder that a good tool has to nail every step: connecting to your sources, correctly classifying transactions, and generating the right forms.

Koinly: The All-Rounder

Koinly has become a giant in this space for a reason. It boasts a staggering list of over 800 integrations with exchanges, wallets, and blockchains, which is a huge relief if your assets are spread out. For most people, this breadth means you can pull in nearly all your transaction data automatically.

The platform is particularly good at making the painful process of reconciliation feel manageable. It intelligently flags transactions that look off—like a sale with no purchase history—and gives you straightforward tools to fix them. Getting from a messy import to a clean Form 8949 is a surprisingly smooth journey.

Koinly’s real magic is its balance. It's powerful enough for heavy DeFi users but still intuitive enough for someone just starting. The clean dashboard cuts through the chaos, and with support for over 20 countries, it’s a go-to for international investors.

The one caveat? Its automation can sometimes struggle with brand-new or obscure DeFi protocols. While it handles giants like Uniswap and Aave perfectly, you might find yourself needing to manually tag transactions from the latest degen farm. It’s a small trade-off for its otherwise massive coverage.

CoinLedger: The User-Friendly Choice

If the thought of crypto taxes makes your head spin, CoinLedger (formerly CryptoTrader.Tax) might be your answer. The platform is built around simplicity, guiding you step-by-step instead of dumping a mountain of data on you. This makes it a fantastic starting point for beginners or anyone who just wants the job done with minimal fuss.

With over 500 integrations, it covers all the major platforms you’d expect. The import process is a breeze, and the dashboard gives you a running tally of your capital gains as you add more data. For many, its direct integration with TurboTax is the killer feature, making the final filing step seamless.

CoinLedger’s main limitation is its depth in DeFi and NFTs. It handles the basics of staking rewards and NFT trades just fine, but if you’re deep into complex yield farming strategies or multi-chain NFT flipping, you might bump up against its limits and wish for the more granular control found in a tool like Koinly.

TokenTax: The Professional-Grade Solution

TokenTax carves out its niche by targeting high-net-worth investors and anyone who’d rather just pay an expert to handle it all. While it offers a do-it-yourself platform, its crown jewel is the tax professional reconciliation service. You can literally hand over your transaction history to a crypto tax pro who will sort out the entire mess for you.

This is a lifesaver for traders with incredibly complex histories who don't have the time or specialized knowledge to untangle it themselves. The software itself is powerful, with excellent support for tricky areas like margin trading and advanced DeFi, where other tools often fall short.

Of course, this premium service comes at a premium price. TokenTax is generally more expensive, and its interface feels more functional than friendly, which might intimidate a casual user. It’s built for power and precision, not necessarily for hand-holding.

TaxBit: The Enterprise Player

It's important to mention TaxBit in this comparison, but with a huge asterisk. In late 2023, TaxBit shut down its product for individual consumers to focus entirely on enterprise clients. It now provides the back-end plumbing for exchanges and institutions to handle tax information reporting, like generating the new Form 1099-DA.

So, what does this mean for you? As an individual investor, TaxBit is no longer an option. You can't sign up for an account to do your own taxes. While the technology might be working behind the scenes at your favorite exchange, it’s not a tool you can use directly.

Feature Comparison of Leading Crypto Tax Software

To make the choice clearer, here’s a side-by-side analysis of the key features that matter most for individual investors. This table cuts through the marketing and focuses on what each platform truly delivers.

| Feature | Koinly | CoinLedger | TokenTax |

|---|---|---|---|

| Best For | All-around use, international investors | Beginners, simple tax filing | Complex portfolios, professional help |

| Integrations | 800+ Exchanges, Wallets, Blockchains | 500+ Exchanges & Platforms | Extensive, with strong DeFi support |

| DeFi & NFT Support | Excellent, but needs review for new protocols | Good for common transactions | Very strong, handles complex scenarios |

| User Interface | Clean and intuitive | Extremely user-friendly and guided | More functional, less beginner-focused |

| Unique Strength | Global tax support and vast integrations | Simplicity and direct TurboTax integration | Optional tax professional reconciliation |

| Pricing Model | Tiered based on transaction count | Tiered based on transaction count | Higher-priced tiers, premium services |

Ultimately, there’s no single "best" crypto tax software. The right tool depends entirely on your portfolio's complexity, your comfort level with the process, and your budget. Koinly strikes the best overall balance, CoinLedger wins on ease of use, and TokenTax offers a premium, white-glove service for those who need it most.

Finding the Right Platform for Your Crypto Activity

The "best" crypto tax software isn't about the one with the longest feature list. It's about finding the right tool for the job. The platform that works perfectly for a simple buy-and-hold investor will likely fall short for a high-volume NFT trader. A smart comparison means matching a tool's strengths directly to your specific needs.

Instead of a generic overview, let's look at which software really shines for three common types of crypto users. This gives you a real-world sense of how each tool would handle your own portfolio.

The Casual Investor

This is someone who mainly uses big, well-known exchanges like Coinbase or Kraken to buy and hold major assets—think Bitcoin and Ethereum. Their transaction history is clean, mostly consisting of buys, sells, and maybe some staking rewards earned right on the exchange.

For this person, simplicity is everything. They need an easy, direct path to getting their tax report done, without getting bogged down in features they'll never use.

Top Recommendation: CoinLedger

For the casual investor, CoinLedger is hands-down the best choice. The entire platform is designed to guide you through the process, step-by-step, taking all the guesswork out of it.

- Effortless Imports: Connecting your exchanges is a breeze. The software pulls in the data cleanly without much fuss.

- Simple Interface: The dashboard is clean and gives you a clear summary of your capital gains. You won't have to hunt through complicated menus to find what you need.

- Direct Tax Filing: Its direct integration with TurboTax is a huge plus, letting you import your crypto tax data in just a few clicks.

For anyone whose crypto life is contained on one or two major exchanges, CoinLedger offers the fastest, most straightforward route from transaction history to a filed tax return. It smartly avoids cluttering the experience with advanced tools that a beginner doesn't need.

Koinly is another solid option here thanks to its clean design, but CoinLedger’s laser focus on simplicity gives it the edge for newcomers.

The DeFi Power User

This investor lives and breathes decentralized finance. They’re providing liquidity on Uniswap, lending assets on Aave, chasing yield across multiple chains, and earning all sorts of governance tokens. Their transaction history is a tangled web of smart contract interactions, not simple trades.

The biggest challenge here is correctly identifying and categorizing thousands of transactions that don't fit the standard "buy" or "sell" mold. A basic tax calculator just won't cut it.

Top Recommendation: Koinly

Koinly has a well-earned reputation for its powerful and mature handling of complex DeFi activity. The team has spent years refining the platform's ability to recognize and correctly classify a huge variety of on-chain transactions.

- Massive Blockchain Support: Koinly connects with hundreds of blockchains, so it can track your activity even on more obscure networks.

- Smart Transaction Tagging: It automatically identifies many common DeFi actions—like adding liquidity, claiming staking rewards, or repaying a loan—and applies the right tax rules.

- Powerful Manual Tools: When it runs into a new protocol it doesn’t recognize, its editing tools are robust enough to let you manually classify transactions, which is critical for accuracy.

This is a big deal. Misclassifying DeFi income as a simple trade could easily lead to you overpaying on your taxes. For those managing these kinds of complex financial flows, having a strong grasp of core principles, like those in our guide on , provides an essential foundation.

The Active NFT Trader

This user is all about non-fungible tokens. They're constantly minting new NFTs, trading on marketplaces like OpenSea and Magic Eden, and juggling transactions that involve royalties, airdrops, and gas fees on chains like Ethereum and Solana.

An NFT trader's biggest tax headache is tracking the cost basis. The true cost of an NFT isn't just its sale price; you have to include the gas fees for minting and buying it to accurately calculate your capital gains later.

Top Recommendation: A Tie Between Koinly and CryptoTaxCalculator

Both of these platforms are excellent choices for NFT traders, but they approach the problem from slightly different angles.

- Koinly is great for its wide support for NFT marketplaces and its knack for correctly bundling gas fees into an NFT's cost basis. Its user-friendly layout also makes it easier to spot and fix any trades that get miscategorized.

- CryptoTaxCalculator was built from day one with complex transactions in mind. It often gives you more fine-grained control for labeling specific NFT mints, airdrops, and sales, which can be a lifesaver for traders with extremely high transaction volumes.

Ultimately, the choice might come down to personal workflow. A trader who also has a significant DeFi portfolio might lean toward Koinly for its all-around capabilities, while a dedicated NFT specialist may prefer the detailed control that CryptoTaxCalculator offers.

Integrating Crypto Tax Software into a Professional Workflow

Picking the right tool from a crypto tax software comparison is a great start, but it's only half the battle. The real magic happens when you integrate that software into a professional, repeatable process. This is where you win on accuracy and efficiency.

At our firm, we’ve developed a system that takes a client's jumbled transaction history and turns it into a clean, audit-ready financial record. It's not just about the software; it’s about blending powerful automation with hands-on, expert oversight. We've built our entire crypto tax service around Koinly, which acts as the central hub for all client data. Its knack for broad integrations and smart reconciliation tools gives us a workflow we can count on every single time.

Step 1: Secure Data Aggregation

Everything starts with getting the data. We begin by securely connecting a client’s accounts to Koinly using read-only API keys and public wallet addresses. This approach is non-negotiable for us—it lets us see the transaction history without ever touching their funds, keeping security front and center.

This first sync can pull in thousands of transactions from dozens of sources, laying the groundwork for everything else. Koinly’s ability to connect with over 800 exchanges and blockchains is a huge time-saver here. It cuts down on the need for manual CSV uploads, which are a notorious source of formatting errors and missing data.

Step 2: Meticulous Reconciliation

Once all the data is in, the real work begins. Let's be honest: no software is perfect. The initial import will almost always have uncategorized transactions, missing cost basis data, or DeFi trades that the system just couldn't figure out. This is exactly where a human expert becomes essential.

Our team dives into Koinly and methodically reviews every single transaction, tackling every red flag. The process involves a few key things:

- Categorizing Unknown Transactions: We manually identify and label transfers, staking rewards, or protocol interactions that the software missed.

- Correcting Cost Basis: We hunt down the original purchase price for assets that show up with a missing cost basis. This is absolutely critical for calculating accurate capital gains.

- Verifying DeFi Activity: We make sure complex activities like adding liquidity to a pool or borrowing against collateral are accounted for correctly based on current tax guidance.

This expert-led reconciliation is the most important step in the entire process. It’s what turns the raw, automated output from a software tool into a verified financial record that can stand up to scrutiny. It closes the gap between data collection and true tax compliance.

Step 3: Generating Final Reports

After every single transaction has been verified and reconciled, we're ready to generate the final reports. Koinly produces a clean and detailed IRS-ready Form 8949, which itemizes every capital gain and loss event for the year. We also pull comprehensive income reports that detail all earnings from staking, airdrops, and other crypto-related activities.

This structured process—from secure import to expert review—shows how a powerful tool, guided by professional know-how, becomes the cornerstone of accurate crypto tax reporting. To see how we apply these principles more broadly, check out our guide on managing a professional services workflow. At the end of the day, this blend of technology and human expertise is what gives our clients the peace of mind they need.

Common Questions About Crypto Tax Software

Even after comparing the top tools, a few questions often pop up. Let's tackle some of the most common ones we hear from investors to make sure you're moving forward with total confidence.

Getting the small details right is what makes for a stress-free tax season.

Do I Really Need Software for Just a Few Trades?

Yes, absolutely. The IRS doesn't care if you made one trade or a thousand; each one is a taxable event. Every time you sell, swap, or even spend crypto, you have to calculate the capital gain or loss based on its cost basis. It's a common myth that small-time trading gets a pass.

Frankly, trying to do this by hand is a nightmare, even with just a few transactions. Good software automates all of it, spits out the Form 8949 you need, and saves you from a potential audit headache. It turns a tedious, error-prone job into a quick, automated process.

How Well Do These Tools Handle DeFi and Staking Rewards?

This is where the good platforms really separate themselves from the pack. Top-tier tools like Koinly are built to understand the complexities of DeFi, automatically identifying income from staking rewards, liquidity pools, and yield farming. It’s a huge time-saver.

That said, nothing is perfect. If you're experimenting with brand-new or obscure protocols, you'll probably need to do some manual review to ensure 100% accuracy. If DeFi is a big part of your strategy, you have to prioritize a tool with mature and robust support for it.

The most reliable crypto tax tools use read-only API access, meaning they can view your transaction history but are explicitly blocked from executing trades or initiating withdrawals. This creates a secure, one-way street for your data.

How Secure Is Connecting My Exchange Accounts?

It's a valid concern, but reputable platforms are designed with security at their core. They use "read-only" API access, which is a technical way of saying they can look but can't touch. The software can see your transaction history but has zero permission to trade or move funds. On top of that, your data is encrypted during transfer and while it's stored.

To keep your accounts locked down, always follow these security basics:

- Use two-factor authentication (2FA) everywhere—on your exchanges and your tax software. No exceptions.

- Stick with platforms that have a long, proven track record and are transparent about their security practices.

- Periodically check which apps have API access to your accounts and cut off any you no longer use.

Managing data securely is a cornerstone of digital finance. You can get a better sense of data compliance frameworks by looking into privacy plugins, like those for managing GDPR consent on websites. The same core principles of secure data handling apply everywhere, from websites to financial tools.

Feeling confident about your crypto taxes starts with the right partner. At Bugaboo Bookkeeping, we combine Koinly's powerful software with our expert oversight to deliver accurate, audit-proof tax reports for investors. Let us handle the complexity so you can focus on your portfolio. https://bugaboobookkeeping.com