Trying to handle your crypto taxes with generic software or a big, faceless national firm can feel like you're walking through a minefield blindfolded. When you search for a "crypto tax accountant near me," you're not just looking for someone to fill out forms. You're looking for a local expert who can shield you from expensive mistakes and give you real, audit-ready confidence. A Washington-based pro brings a level of insight that the national chains just can't offer.

Why a Local Crypto Tax Expert Is Non-Negotiable

It's completely normal to feel overwhelmed by your crypto tax situation, especially with the IRS ramping up its focus on digital assets. The pull of DIY tax software is strong, but honestly, these tools often buckle under the weight of real-world crypto complexity.

Think about a pretty common scenario: you’ve dabbled in DeFi lending, staked some assets to earn rewards, and maybe even minted a few NFTs. A standard tax program can easily get tangled up trying to calculate the cost basis for all that activity. This can lead you to overpay your taxes or, even worse, underreport your income and risk penalties.

Beyond the Basics of Federal Filing

This is where a local expert really proves their worth. A specialist right here in Washington doesn't just know federal tax law; they're dialed into the state-specific details that can affect your filings. For instance, some of your crypto activities might have implications for Washington's Business and Occupancy (B&O) tax—a nuance a national firm a thousand miles away would likely miss entirely. Getting proper guidance on Washington state small business taxes (https://bugaboobookkeeping.blog/washington-state-small-business-taxes/) is a massive advantage of working with someone local.

The goal isn't just to file your taxes. It's to file them correctly, defensibly, and in a way that's financially smart for you. A local expert provides the strategic thinking that software just can't mimic.

The Problem with a Purely Automated Approach

The crypto tax software market is exploding for a reason. Its value is expected to jump from $4.402 billion in 2024 to an eye-watering $47.6 billion by 2035, all because investors are trying to keep up with dizzying reporting rules.

But here’s the catch: while tools like Koinly or CoinLedger are fantastic for pulling all your data together, they aren't a replacement for professional judgment. An app can’t:

- Rebuild your transaction history from a crypto exchange that went bust.

- Advise you on whether FIFO or HIFO is the better accounting method for your trading patterns.

- Figure out the tax implications of a brand-new DeFi protocol that the IRS hasn't even issued guidance on yet.

This is the gap that a human expert fills. A quick comparison makes it even clearer:

DIY Crypto Taxes vs Hiring a Specialized Accountant

| Aspect | DIY with Software | Hiring a Crypto Tax Accountant |

|---|---|---|

| Data Handling | You manually connect APIs and upload CSVs. Errors are on you to find and fix. | An expert reviews and reconciles your data, spotting inconsistencies you might miss. |

| Complex Transactions | DeFi, NFTs, and airdrops often require manual classification, with a high risk of error. | Specialist knowledge to correctly categorize complex events and apply the latest IRS guidance. |

| Strategic Advice | None. Software only processes the data you give it. | Strategic advice on tax-loss harvesting, accounting methods, and future planning. |

| Audit Support | You're on your own if the IRS comes knocking. | Professional representation and a defensible, audit-ready return. |

| State-Specific Rules | Often overlooked, leading to potential compliance issues (e.g., WA B&O tax). | In-depth understanding of local and state tax laws that apply to your situation. |

| Time & Stress | Can take dozens of hours and cause a lot of anxiety, especially with messy data. | Saves you significant time and provides invaluable peace of mind. |

Ultimately, hiring a local crypto tax accountant means you have a real partner who can untangle the mess, turning a chaotic transaction history into a compliant, optimized tax return. That kind of peace of mind is priceless.

How to Actually Find the Right Accountant

Let’s be honest, just Googling "crypto tax accountant near me" is a roll of the dice. You might get lucky, but you're more likely to find generalists who've only dabbled. Finding a true expert—someone who won’t get tripped up by your DeFi activity—requires a smarter approach.

The goal isn't just to find an accountant; it's to build a shortlist of qualified pros who have seen a crypto situation just like yours before. It's about looking in the right places from the start.

Go Beyond a Basic Google Search

Instead of casting a wide, generic net, it's time to get specific. Start your search on platforms where professionals are already vetted or showcase their niche expertise.

-

CPA Directories: Many state-level CPA societies (like the WSCPA in Washington) have directories. Use their filters to search for members who specifically list "cryptocurrency" or "digital assets" as a practice area. This immediately narrows the field to serious practitioners.

-

LinkedIn Sleuthing: LinkedIn can be a goldmine if you use its advanced search. Look for titles like "crypto accountant" or "digital asset CPA" and filter the results by location to Washington. Scan their profiles—do they mention specific crypto tax software? Do they post about DeFi or NFTs? This is where you find the engaged experts.

A focused search like this helps you cut through the noise. You’ll quickly find people who are genuinely deep in the crypto world, not just trying to add a new buzzword to their services.

You're not just looking for someone who can fill out a form. You need an expert who already knows the difference between staking rewards, liquidity pool fees, and NFT minting costs without you having to explain it.

Ask the Local Crypto Community

Who better to ask for a recommendation than fellow investors? Tapping into the local scene can give you honest, firsthand reviews from people who’ve already done the hard work of vetting someone.

-

Find Local Meetups: Check out sites like Meetup.com for Bitcoin, Ethereum, or general blockchain groups in places like Seattle, Bellevue, or Spokane. Getting a word-of-mouth referral at one of these events is often the most reliable way to find a pro.

-

Check Online Forums: Jump into crypto-focused forums on Reddit (like r/cryptocurrency) or local Discord groups. Just be smart about it. You can ask for recommendations for accountants who have successfully navigated complex tax situations for other members.

Fine-Tune Your Shortlist

Once you have a handful of potential names, it's time to zero in on the best fit. Your goal is to find someone whose experience directly mirrors your activity.

For example, if most of your transactions are on Kraken and you do a lot of DeFi through MetaMask, look for an accountant who explicitly mentions experience with those platforms. A specialist who already understands the quirks of their transaction reports and data formats will save you a ton of time and money.

This extra bit of homework up front is what turns a frustrating search for a crypto tax accountant near me into a successful partnership.

The Essential Vetting Checklist Before You Hire

Alright, you've done the initial legwork and have a shortlist of potential accountants. This is where the real work begins. It’s time to separate the true crypto tax specialists from the generalists who might be in way over their heads.

A quick, surface-level chat won't cut it. You need to dig in with targeted, scenario-based questions that reveal their actual, hands-on experience. This isn't just about finding someone who can plug numbers into software; it's about finding a partner who understands the nuances and can confidently defend their work if the IRS ever comes knocking.

Gaging Their Real-World Crypto Expertise

Don't just ask, "Do you handle crypto taxes?" The answer will almost always be "yes." You have to go deeper to test their practical knowledge and problem-solving skills. Real expertise is in the details.

Try hitting them with some of these hard-hitting questions:

- Scenario-Based Problems: "Let's say I have missing transaction history from a defunct exchange like FTX or Celsius. What's your game plan for reconstructing my cost basis?"

- DeFi and NFT Nuances: "How do you treat staking rewards versus income from a liquidity pool? And how would you determine the cost basis for an NFT I minted myself?"

- Accounting Methods: "Walk me through your process for choosing the best cost basis accounting method, like FIFO or HIFO, for my specific trading style."

A seasoned crypto tax pro will have clear, confident answers. They won't hesitate because they've dealt with these exact issues time and time again. To get a better handle on the rules they should be following, check out our guide on the latest IRS crypto tax rules and see how their answers stack up.

Understanding Their Process and Tools

How an accountant works is just as critical as what they know. You need to trust their process for managing and reconciling your data. Accuracy is everything.

Individual crypto investors have been the main drivers behind the boom in tax software. In fact, cloud-based platforms are projected to hit a $210.6 million market share in 2025, a figure expected to soar to $683.9 million by 2035. This massive growth comes from their ability to sync with exchanges and wallets, making sense of huge trade volumes. You can find more insights on the crypto tax software market on futuremarketinsights.com.

An expert doesn’t just let software spit out a number. They use it as a tool, then manually review and reconcile the data to make sure every single transaction is categorized correctly.

With that in mind, ask them about their technical workflow:

- Software Proficiency: Which crypto tax software platforms (like Koinly or CoinLedger) are you most comfortable with? More importantly, how do you handle their limitations or fix categorization mistakes?

- Data Reconciliation Process: What's your procedure for verifying that the data imported from my exchanges and wallets is actually accurate? How do you hunt down and fix discrepancies?

- Client Collaboration: How will we stay in touch? What secure platform do you use for sharing sensitive documents?

Clarifying Fees and Deliverables

Last but not least, get total clarity on the business side of things. The last thing you want is a surprise on your invoice after tax season is over.

- Fee Structure: Do you bill hourly, or do you offer a flat fee? Can you give me a fixed-fee proposal once you've had a chance to look over my transaction history?

- Final Deliverables: What specific documents will I get from you when this is all done? You should expect an IRS Form 8949 and a detailed capital gains and losses report at a minimum.

- Timeline: Based on what you know about my situation, what’s a realistic timeline for getting this done once you have all my data?

Running through this vetting process will give you the confidence that you’re hiring a genuine expert. It ensures your search for a "crypto tax accountant near me" ends with finding a pro who can handle your portfolio’s complexity with the precision and care it deserves.

Getting Your Data Ready for a Smooth Handoff

Want to know the secret to making your accountant happy and keeping your bill down? Show up with organized data. When you walk into that first meeting prepared, your accountant can dive right into the good stuff—like finding ways to lower your tax bill—instead of spending hours just cleaning up your transaction history.

Think of it like this: you wouldn't call a mechanic about a weird engine noise and refuse to let them see the car. Your crypto tax accountant needs the full picture of your transaction history to do their job right. Getting everything together beforehand is the single best thing you can do to make the whole process faster, cheaper, and less stressful.

Assembling Your Crypto Data Dossier

Your main goal here is to create a complete, unbroken record of every single crypto transaction you’ve ever made. I'm talking about buys, sells, trades, staking rewards, airdrops, NFT mints—everything.

Here’s what you need to start pulling together:

-

Centralized Exchange Histories: You’ll need a complete transaction history from every single exchange you've used, like Coinbase, Kraken, or Binance. Most platforms will let you export this as a CSV file. Even better is providing read-only API access to your accountant, which gives them a live, accurate feed of your activity.

-

Wallet Addresses: Make a list of the public addresses for all your self-custody wallets. This includes both hot wallets like MetaMask and cold storage like a Ledger or Trezor. Your accountant will use these addresses to pull your on-chain data directly from the blockchain.

-

Off-Exchange Activity: Did you do any peer-to-peer (P2P) trades? Get paid for a gig in crypto? Buy an asset directly from a friend? You need to document these, too. Jot down the dates, amounts, and what the fair market value in USD was at the time of the transaction.

This initial data dump is the absolute foundation for your tax reporting. Without it, your accountant is just guessing.

How Software Can Do the Heavy Lifting

Let's be real: manually tracking thousands of transactions across multiple wallets and exchanges is a nightmare. This is exactly why crypto tax software is non-negotiable for both you and your accountant. Platforms like Koinly are built specifically to pull all this scattered data into one place.

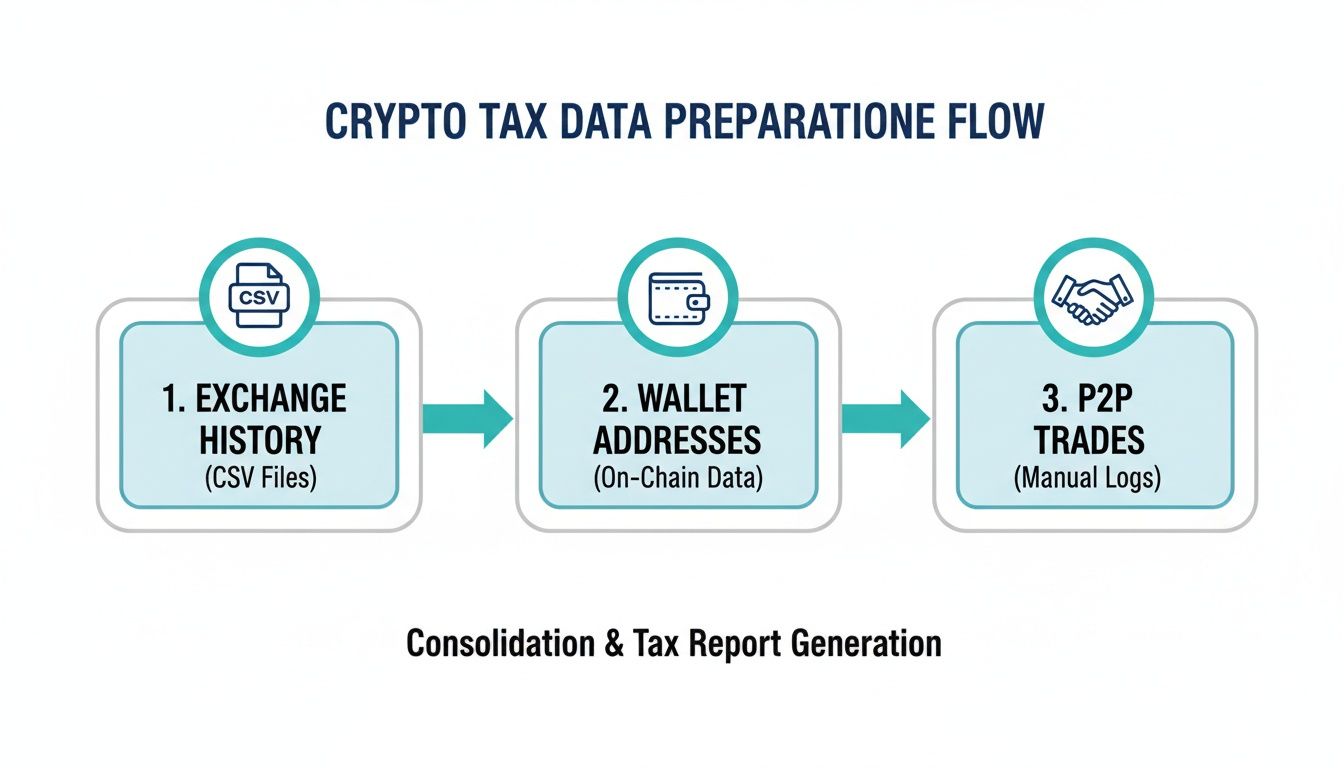

Here’s a glimpse of how a tool like Koinly can consolidate your transaction data from all over the crypto-verse.

The software plugs directly into your exchanges and wallets, automatically categorizing most of your transactions. It also flags anything that looks off and needs a human to review it.

By getting your data loaded into a tool like Koinly before you hand it over, you slash the amount of manual work your accountant has to do. This one step can literally save you hundreds, or even thousands, of dollars in fees. While the software is great for compiling tax data, many businesses also need this information in their main bookkeeping system. If that's you, check out our guide on how to import transactions into QuickBooks Online.

Pro Tip: When you generate an API key for your accountant, always, always make sure it's set to read-only access. This lets them see what they need to see without giving them any power to move or touch your funds. Your assets stay completely secure.

Ultimately, getting prepared is all about creating a clean, complete, and verifiable audit trail of your crypto journey. The more organized you are on the front end, the less you'll pay and the smoother the entire tax season will be.

Understanding the Crypto Tax Preparation Process

Let's pull back the curtain on what actually happens when you work with a crypto tax pro. Knowing the roadmap can make tax season a whole lot less intimidating. It's not about just dumping a folder of files on someone's desk; it's a collaborative process to build a rock-solid, accurate tax return.

Everything kicks off with an initial chat to go over the scope of your crypto life—what you've been trading, staking, or aping into. From there, you'll securely send over your data, usually through read-only API keys or CSV file exports from all your exchanges and wallets.

The All-Important Reconciliation Phase

This is where the magic—and the real work—happens. Once your accountant has all your raw data, they’ll pull it into specialized software. But this is way more than just hitting an "import" button. Think of it as a forensic investigation into your transaction history.

Your accountant will be meticulously digging through every single transaction, looking for the common pitfalls that trip up even savvy investors.

- Missing Data: What about that old exchange that went under? Or that self-custody wallet you haven't touched in years? They'll help you track down and fill in those gaps.

- Incorrect Categorization: DeFi can be a mess. The software might mistake a liquidity pool deposit for a simple trade, or misclassify staking rewards. A human expert corrects these errors.

- Cost Basis Calculation: This is the big one. They ensure every single coin, token, and NFT has the correct cost basis assigned to it. Without this, your capital gains and losses calculations are pure fiction.

This flowchart gives you a sense of all the different data streams that need to be wrangled into a single, cohesive history.

As you can see, data from CEXs, personal wallets, and even P2P trades all has to be combined to get the full picture the IRS wants to see.

From Draft Review to Final Deliverables

After the heavy lifting of reconciliation is done, you won't be left in the dark. You’ll get a draft of the reports to look over. This is your opportunity to ask questions and make sure the story the numbers tell matches your memory of the year's activity. A great accountant will walk you through it.

Once you give the green light, they'll generate the final documents you need for filing.

Your final package should, at a minimum, include a completed IRS Form 8949 (Sales and Other Dispositions of Capital Assets) and a detailed capital gains report. That report is your audit-proof record of every calculation.

Heads up: the game is changing. Starting with the 2025 tax year, the IRS is rolling out the new Form 1099-DA. This means exchanges will report your activity directly to them, making it incredibly easy for them to spot discrepancies on your return. The stakes for getting it right have never been higher.

Pairing professional expertise with the right software is the best way to stay ahead. For a closer look at the platforms accountants use, see our crypto tax software comparison.

Finally, a quick word on what to expect for pricing and timelines. A simple case with just a few exchanges might only take a week. But if you have a complex history with thousands of DeFi transactions, expect it to take several weeks. Most specialists will give you a fixed-fee quote after a quick look at your accounts, so you won’t have to worry about surprise bills.

Answering Your Lingering Questions

Alright, you've done your homework and narrowed down your list of potential crypto accountants. But a few questions are probably still nagging at you before you pull the trigger. That's completely normal—hiring an expert is a big decision, and you want to be sure.

Let's tackle some of the most common questions I hear from Washington investors when they're at this exact stage.

How Much Should I Expect to Pay a Crypto Tax Accountant in Washington?

This is usually the first thing people ask, and the honest answer is: it really depends on the messiness of your situation.

For someone with a pretty clean history—maybe a few hundred trades on a couple of major exchanges like Coinbase or Kraken—you might be looking at a starting price in the low hundreds. This is for straightforward buying, selling, and holding.

But if you've been deep in the crypto world with thousands of transactions, dabbling in DeFi, minting NFTs, or earning staking rewards across a half-dozen different wallets, the cost will reflect that complexity. Reconciling that kind of activity takes serious time and expertise, so fees can easily climb into the several thousand-dollar range.

My advice: Look for a specialist who offers a free initial consultation to look over your transaction volume and then gives you a fixed-fee proposal. This is a huge green flag. It shows they've seen situations like yours before and know what it takes, protecting you from the sticker shock of unpredictable hourly billing.

Why Not Just Use a Big National Online Service?

It's tempting, I get it. Those big online tax services are everywhere. And while they can certainly handle a federal return, you lose a massive advantage by not working with someone local to Washington.

A local pro understands the nuances of our state's tax code, like the potential for Business and Occupancy (B&O) tax to apply to certain crypto activities—something a national chain might completely overlook.

Plus, building a relationship matters. When you search for a "crypto tax accountant near me," you're really looking for a partner you can call directly. You get to speak with the person who is actually doing the work, not a random agent in a call center who has no idea about your unique crypto journey. That direct line is priceless. A great way to get organized for your first meeting is by using a small business tax preparation checklist to make sure nothing gets missed.

What Happens if I Have Missing Data From an Exchange That Shut Down?

This is a classic crypto problem, and honestly, it's where a seasoned crypto accountant earns their keep. A real pro has seen this dozens of times and won't even flinch.

They have a process for this. An expert will help you piece together your transaction history using whatever you have left—blockchain explorer data, old bank statements, and any email confirmations you can dig up.

Where data is gone for good, they'll use an accepted, good-faith method to reconstruct your cost basis, carefully documenting every single step. This documentation becomes your shield, giving you a solid, defensible position if the IRS ever comes knocking.

Sorting out crypto taxes requires a specialist who is fluent in both the technology and the ever-changing tax code. At Bugaboo Bookkeeping, our team delivers expert crypto tax preparation for Washington investors, making sure your Form 8949 is accurate, complete, and audit-proof. Ready to get started? Schedule your free consultation today at https://bugabooookkeeping.com.