Navigating Washington state small business taxes can feel like you've landed in a foreign country. Why? Because our system is built differently than almost anywhere else in the U.S. We don't have a corporate or personal income tax. Instead, the state runs on a gross receipts tax—the Business and Occupation (B&O) tax—plus the sales and payroll taxes you might be more familiar with.

This unique setup can be a minefield for new entrepreneurs, but it also creates its own set of rules you can learn to master.

Your Guide to Washington State Business Taxes

Think of Washington’s tax system as a three-legged stool. For your business to be stable and compliant, you need to understand each leg. This guide is your map through the maze, clearing up the rules so you can handle your tax duties with confidence and get back to growing your business.

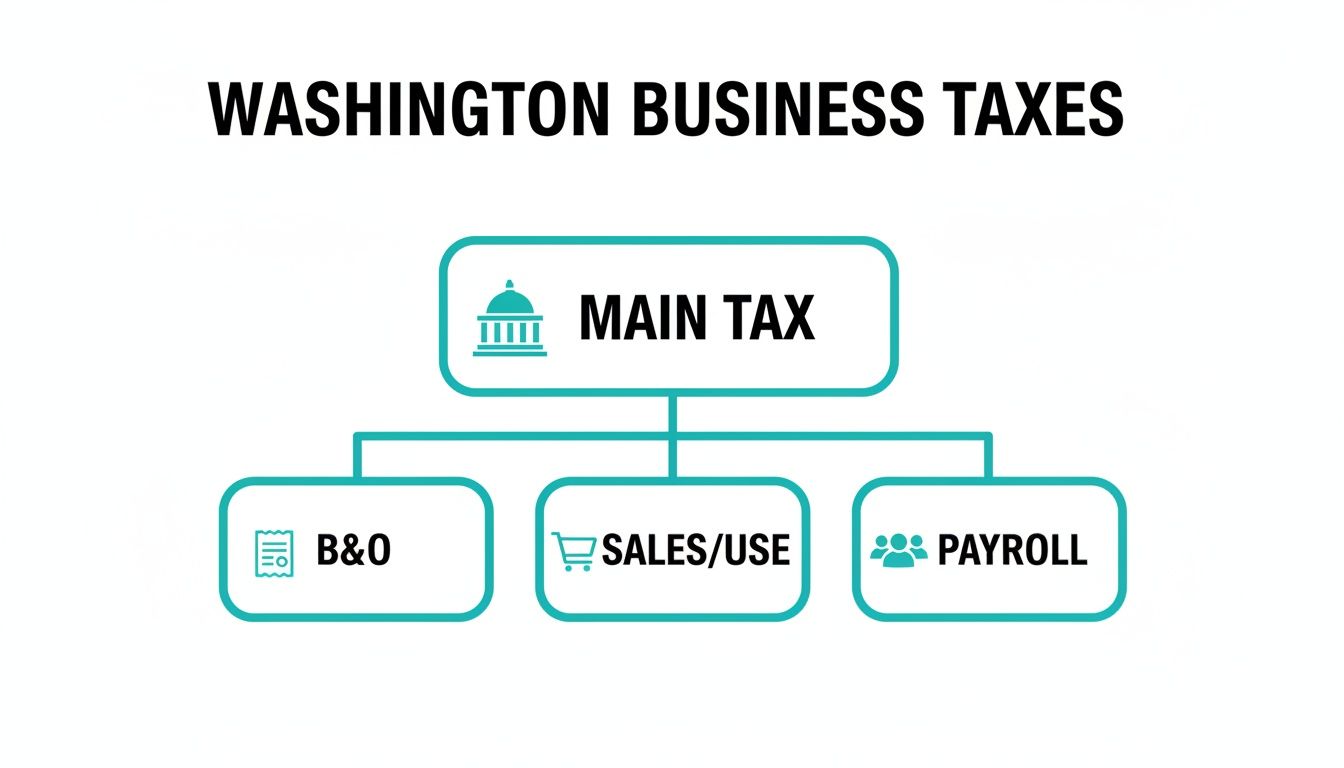

The main taxes you’ll need to get a handle on are:

- Business and Occupation (B&O) Tax: This is the big one. It's a tax on your total gross revenue, not your profit.

- Sales and Use Tax: Here, you're acting as a tax collector for the state on qualifying sales.

- Payroll Taxes: These are state-level responsibilities for unemployment insurance and our paid leave program.

Understanding the Washington Tax Landscape

If you’re used to the federal system where you're taxed on profit, Washington's B&O tax requires a major mental shift. It’s calculated before you subtract any of your business expenses—no deductions for rent, payroll, inventory, or anything else. This means a business that breaks even or even loses money in a given period could still owe a substantial B&O tax bill. It's a shock to the system for many new owners.

The key takeaway is that in Washington, every dollar of revenue counts. This gross receipts model makes meticulous financial tracking not just good practice, but a necessity for survival and accurate tax filing.

We're going to break down each major tax you'll face, starting with the foundational B&O tax and moving through the details of sales, use, and employer taxes. You'll learn how to get registered, figure out how often you need to file, and stay on the right side of the Department of Revenue. If you're just starting out, getting these concepts down early is crucial, and a solid grasp of is your best first step toward building a successful, compliant company.

Getting to Grips with Washington's Unique B&O Tax

If you're new to business in Washington, the Business and Occupation (B&O) tax is probably the most confusing hurdle you'll face. It forces a complete mental shift from how you might think about taxes. Unlike income tax, which is based on your profit after expenses, the B&O tax is a gross receipts tax.

What does that mean in practice? Imagine your business brings in $100 from a sale. The state takes its cut from that top-line $100 before you've paid for rent, supplies, or payroll. This is a huge deal, because it means a business that's barely breaking even—or even losing money—could still owe a hefty B&O tax bill.

This flowchart gives you a bird's-eye view of where the B&O tax fits into the bigger picture of state business taxes.

As you can see, B&O is a core pillar of your tax obligations, standing right alongside sales and payroll taxes.

Finding Your B&O Tax Classification

Here’s where it gets a little more complex: not all money is taxed the same. The Washington Department of Revenue sorts your business activities into different B&O tax classifications, and each one has its own tax rate. It’s entirely possible for a single business to report income under several different classifications.

Think of a marketing agency that provides consulting services but also resells printed brochures to its clients. The consulting income would fall under the "Service and Other Activities" classification, while the money from the brochures gets reported under "Retailing."

To help you get your bearings, here are some of the most common classifications and their corresponding rates.

Common B&O Tax Classifications and Rates

| B&O Classification | Description | Typical State Tax Rate |

|---|---|---|

| Retailing | Selling goods or certain services directly to the final consumer. | 0.471% (plus you collect sales tax) |

| Wholesaling | Selling goods to another business that will then resell them. | 0.484% (no sales tax collected) |

| Manufacturing | The act of creating new products from materials. Tax is on the product's value. | 0.484% |

| Service & Other | The catch-all for most professional services, consulting, and other activities. | 1.5% (for most small businesses) |

This table is just a starting point, but it shows how crucial it is to categorize your revenue correctly. Getting it wrong means you could be paying the incorrect tax rate, leading to compliance headaches down the road.

Key takeaway: It's your business activity, not your business entity type (like LLC or S-Corp), that dictates your B&O tax classification. You have to get this right to stay compliant.

Heads Up: B&O Tax Rates Are Changing

The B&O tax goalposts have recently moved, especially for service-based businesses. Washington introduced a new tiered rate structure for the "Service and Other Activities" classification.

Here’s the breakdown:

- Businesses with affiliated group gross income under $1 million still pay 1.5%.

- Those between $1 million and $5 million now pay 1.75%.

- And for those over $5 million, the rate jumps to 2.1%.

This change can put a real squeeze on businesses with thin profit margins, since the tax is on revenue, not profit. It pays to stay on top of the latest Washington State tax changes to see how your bottom line might be affected.

Since B&O is based on gross income, disciplined expense tracking is essential for managing your cash flow, even though those expenses aren't deductible from this specific tax. A clear picture of your finances helps you plan for these top-line tax hits. You can explore a solid framework for this in our guide to tracking business expenses.

A Real-World Example: A Graphic Design Studio

Let's ground this with a practical scenario. We’ll call our business "Pixel Perfect," a small design studio in Olympia.

-

Consulting Work: They land a project and charge the client $5,000 for branding strategy and design. This is a service, so the income falls under the Service and Other Activities classification. At a 1.5% rate, their B&O tax on this is $75 ($5,000 x 0.015).

-

Reselling Print Jobs: As part of the project, they also coordinate and resell $1,000 worth of business cards to the client. This is a retail sale. This income gets reported under the Retailing classification (taxed at 0.471%), for a B&O tax of $4.71 ($1,000 x 0.00471). They also have to collect the local retail sales tax on that $1,000.

When it's time to file, Pixel Perfect will report income and pay B&O tax under two separate classifications on their single excise tax return.

Don't Forget the Small Business B&O Tax Credit

The state understands that a gross receipts tax can be tough on small operations. That's why the Small Business B&O Tax Credit exists. If your revenue is below certain thresholds, this credit can dramatically reduce or even completely wipe out what you owe.

The credit works on a sliding scale—the less taxable income you have, the bigger your credit. It’s an absolute lifeline for startups and growing businesses, but there's a catch: it is not automatic. You must claim it on your tax return. Make sure you check the Department of Revenue's current thresholds each filing period to see if you qualify.

Getting a Handle on Sales and Use Tax

If you run a small business in Washington, you'll quickly learn that you often act as a tax collector for the state. This is especially true when it comes to sales and use tax—two sides of the same coin that are crucial to get right.

Here’s the simplest way to think about it: Sales tax is what you collect from customers when they buy your products or services. Use tax, on the other hand, is what you owe the state when you buy something for your business without paying sales tax at the time of purchase.

This usually pops up when you buy from an out-of-state online store that doesn’t collect Washington sales tax. For instance, if you order a new printer for the office from a retailer that doesn’t charge you sales tax, you’re on the hook for reporting and paying that use tax directly to the state. It's the state’s backstop to ensure tax is paid on goods used in Washington, no matter where they came from.

The Challenge of Destination-Based Sales Tax

Here’s where things get tricky for Washington businesses. We have a destination-based sales tax system. This means you don't use the tax rate from your shop's location; you have to charge the combined state and local rate for wherever your customer receives the goods.

For a local coffee shop, that’s easy—the customer is right there. But if you ship products or deliver services across the state, it becomes a logistical puzzle. An e-commerce seller in Seattle shipping an order to Spokane must calculate and collect the Spokane-area sales tax rate, not the Seattle one.

This requires real diligence. Rates vary from city to city and county to county, with special taxing districts thrown in for good measure. Charge the wrong rate, and you could end up either shorting the state (and paying the difference yourself) or overcharging your customers.

Do You Need to Charge Sales Tax on Services?

While we typically associate sales tax with physical products, Washington has been expanding its reach. Recent changes broadened the definition of a "retail sale" to cover many digital and professional services, pulling a whole new group of small businesses into the tax collection game.

This list now includes things like advertising, certain IT support, and software development. For many service firms that were previously exempt, this is a brand new responsibility. According to the Washington Policy Center, these changes are expected to bring in $1.1 billion in new revenue.

It's absolutely critical to confirm whether your specific services now fall under this umbrella. Mistakenly thinking your service is non-taxable is one of the most common—and expensive—errors a business owner can make.

The golden rule for Washington sales tax is simple: location matters. Always base your sales tax calculation on your customer's delivery address, not your own. Failing to do so is one of the quickest ways to fall out of compliance.

Tools and Best Practices to Stay Compliant

Thankfully, you don't have to navigate this alone. The Washington Department of Revenue (DOR) offers some fantastic resources to help you get it right.

- DOR's Tax Rate Lookup Tool: This should be your go-to resource. You can plug in any Washington address and get the exact, up-to-the-minute sales tax rate for that location. They even have a downloadable database you can integrate into your e-commerce or point-of-sale software.

- Keep Meticulous Records: You absolutely must track every sale, including the amount and the sales tax you collected. This paperwork is your proof of compliance if you ever face an audit.

- Understand Reseller Permits: If you buy goods specifically to resell them, you can use a reseller permit to purchase that inventory tax-free. Just remember, this shifts the full responsibility onto you to collect sales tax from the final customer.

Juggling all these details can feel like a lot, which is why solid bookkeeping is non-negotiable. To get your financial house in order, take a look at our guide on essential small business accounting tips and make sure your records are always clean and audit-ready.

Managing State Payroll and Employer Taxes

The moment you hire your first employee in Washington, you’ve officially stepped into a new role. Beyond being a business owner, you're now an employer, which comes with a whole new set of payroll tax responsibilities. The good news? Washington doesn't have a state income tax, so you don't have to worry about withholding that from your team's paychecks.

But that doesn't mean you're off the hook. There are several key employer-paid taxes you need to manage. These aren't deductions from your employee’s wages; they are costs your business pays directly to support the state’s safety net programs for workers.

Getting these calculations right and paying them on time is non-negotiable for staying compliant. Messing it up can lead to a headache of penalties and interest charges that eat into your cash flow. More importantly, understanding these costs from the get-go helps you budget for the true cost of bringing on an employee.

Unemployment Insurance Explained

First up is the state’s Unemployment Insurance (UI) program. This is the fund that provides a temporary lifeline to workers who lose their job through no fault of their own. Your business contributes to this fund through a UI tax.

Now, your UI tax rate isn't a flat number for everyone. Washington uses what's called an "experience rating." This is a fancy way of saying your rate is tied directly to how many of your former employees have filed for unemployment benefits. If you maintain a stable workforce with low turnover, you'll generally earn a lower tax rate over time compared to a business with frequent layoffs.

When you're a new employer, the state will assign you a starting rate based on your industry's average. As you build a history, your unique experience will take over, and your rate will be adjusted up or down based on your company's actual claim history.

Key Insight: Think of your UI tax rate as a reflection of your workforce stability. Keeping your team employed and happy doesn't just help your business run smoothly—it can literally lower your tax bill.

Navigating Workers' Compensation Premiums

The next big piece of the puzzle is Workers’ Compensation insurance. This is managed by the Washington State Department of Labor & Industries (L&I), and it’s a no-fault system that covers medical bills and lost wages for employees who get sick or injured on the job.

Much like UI, your workers' comp rates are specific to your business. But instead of being based on layoff history, these premiums are all about the risk classification of the actual work your employees do. It makes sense, right? The risk for an accountant working at a desk is far lower than for a roofer, and the premium rates reflect that.

L&I assigns different "risk class codes" to every conceivable job duty. You pay premiums based on the hours your employees work under each specific code. Getting these classifications right is crucial for accurate payroll, which is the foundation of your financial reporting. If you’re curious how these numbers flow through your books, it’s worth understanding how they impact your profit and loss statement.

Paid Family and Medical Leave Premiums

Washington also has a fantastic Paid Family and Medical Leave (PFML) program, which gives workers paid time off for major life events, like having a baby, recovering from a serious illness, or caring for a sick family member.

Funding for this program is a team effort—both you and your employee contribute. Here's how it generally works:

- Employee Portion: A percentage is withheld directly from your employee's paycheck. You are responsible for collecting this.

- Employer Portion: You also contribute a percentage of their wages. However, there’s a big exception: businesses with fewer than 50 employees don’t have to pay the employer share. You still have to collect the employee's portion and send it to the state, though.

This shared model keeps the program healthy while spreading the cost. It’s another key line item you'll handle with your quarterly payroll tax filings.

Filing Your Taxes and Staying Compliant

Getting a handle on the different Washington state small business taxes is one thing, but actually filing and paying them on time is where the rubber meets the road. This is what keeps your business in good standing and the state happy. Let's walk through the practical steps of tax compliance.

It all starts with getting registered. Before you can report a single sale or pay a dime in taxes, you have to apply for a Washington State Business License. This process is what gets you your Unified Business Identifier (UBI) number—a nine-digit code that’s basically your business's social security number for all state agencies. Think of it as the master key that lets you file taxes, bring on employees, and operate legally.

Determining Your Filing Frequency

Once you’re in the system, the Department of Revenue (DOR) will tell you how often you need to file. This is your "filing frequency," and it’s based on how much tax they estimate you'll owe over the year. This schedule covers your combined excise tax return, which conveniently bundles both B&O and sales tax.

Your assigned frequency will be one of three options:

- Monthly: This is for businesses with a higher tax liability. Your return is usually due by the 25th of the month after the one you're reporting.

- Quarterly: This is the most common assignment for small businesses. These returns are due by the last day of the month after the quarter ends (for example, April 30 for the first quarter).

- Annually: If your tax liability is quite low, you'll likely land here. Your one annual return is due by April 15 of the following year.

Whatever your frequency, get those deadlines on your calendar immediately. Missing one isn't a slap on the wrist; penalties start at 9% of the tax you owe and can jump all the way to 29% if you’re more than two months behind.

How to File Using My DOR

Thankfully, Washington makes the filing process fairly straightforward with its online portal, My DOR. This is your one-stop shop for filing that combined excise tax return.

Here’s a quick rundown of what it looks like in practice:

- Log In: Head to the My DOR portal and access your business account.

- Select Filing Period: Choose the correct month, quarter, or year you're filing for.

- Enter Gross Income: Start by reporting your total revenue for the period, before any deductions.

- Categorize Your Income: This is the most crucial part. You'll need to assign your gross income to the right B&O tax classifications (like Retailing or Service and Other Activities) and claim any valid deductions.

- Report Sales Tax: Next, you'll enter your total taxable sales and the sales tax you collected from customers. The system is pretty good at helping calculate the final amount owed.

- Claim Credits: Don't leave money on the table! This is where you claim any credits you're eligible for, such as the popular Small Business B&O Tax Credit.

- Review and Submit: Give everything one last look to make sure the numbers are right, then submit your return and schedule your payment.

The secret to a stress-free filing is staying organized all month (or quarter) long. Using something like our small business tax preparation checklist can help you pull together all the documents you need before you even open your browser.

There's no sugarcoating it—the tax load here can feel heavy. A recent business tax study from the Council on State Taxation found that Washington businesses pay an average of $10,100 per employee in state and local taxes, a figure that’s 18.8% higher than the national average.

Staying compliant is about so much more than just avoiding penalties. It’s about protecting the good standing of your business. A clean tax history is vital when you're trying to get a loan, attract investors, or simply build a company that lasts.

Answering Your Washington Tax Questions

If you're running a small business in Washington, you've probably got questions. The state's tax system has some unique quirks, and getting your head around them is key to staying out of trouble and managing your cash flow. Let's tackle some of the most common questions we hear from entrepreneurs just like you.

One of the first and biggest surprises for new business owners is the B&O tax, especially when the business isn't making any money yet.

Do I Pay B&O Tax if My Business Isn't Profitable?

Yes, you do, and this is a crucial detail to understand about Washington's system. The B&O tax is a gross revenue tax, which is a completely different beast from an income tax. That means you owe tax on every dollar that comes in the door, before you subtract your rent, payroll, or any other business expenses.

But there's good news for smaller operations. Washington offers a Small Business B&O Tax Credit that can significantly lower or even wipe out what you owe, as long as your revenue stays below a certain level.

What's the Difference Between a Reseller Permit and a Business License?

Think of it like this: your Business License is your basic permission slip to operate in Washington. It gets you your UBI number and makes your business official.

A Reseller Permit, on the other hand, is a specialized tool for a specific job. If you buy products just to turn around and sell them to customers, this permit lets you buy those items wholesale without paying sales tax. You have to have a business license first, but you only need the reseller permit if you're actually in the business of reselling.

How Do I Handle Sales Tax for Online Sales Across Washington?

For online sales, it’s all about where your customer is. Washington is a "destination-based" sales tax state, meaning you have to charge the exact sales tax rate for your customer's shipping address.

You can't just use one flat rate for the whole state because the total rate changes from city to city and county to county. The Washington Department of Revenue has a fantastic online lookup tool that gives you the precise rate for any address. If you sell online, this tool is your best friend.

The bottom line for online sellers is that your customer's location dictates the tax rate. Always look up and charge based on their address. Getting this wrong can lead to some painful tax bills down the road.

Finally, a common point of confusion is whether you need to charge sales tax on services.

The short answer is: maybe. Nearly all services are subject to the B&O tax under the broad "Service and Other Activities" classification. However, only some of those services also require you to collect retail sales tax from your clients. You'll need to check with the DOR to see how the services you offer are classified.

Feeling like you're drowning in tax rules? The team at Bugaboo Bookkeeping lives and breathes this stuff. We specialize in untangling B&O, sales tax, and payroll for Washington businesses. Visit us at https://bugaboobookkeeping.com to book a free consultation and get your finances sorted out for good.