When we talk about blockchain and accounting, we're really talking about a fundamental shift in how we handle our books. It moves us away from the traditional, often siloed, methods and toward a system that's inherently more secure, transparent, and even automated. By using a shared, unchangeable digital ledger, this technology gives everyone involved a single, reliable source of truth for financial transactions. This alone dramatically cuts down on errors and the risk of fraud.

How Blockchain Is Redefining Accounting Fundamentals

To get a feel for how blockchain impacts accounting, picture a shared digital receipt book. Every time a transaction happens, a new entry gets added, complete with a timestamp, and it's cryptographically linked to the one before it. This process creates a "chain" of blocks that everyone with permission can see at the same time.

But the real game-changers are two core ideas: decentralization and immutability.

Decentralization and Immutability

In a typical setup, one person or company holds the master ledger. That's a centralized system. With blockchain, a copy of that ledger is spread across a whole network of computers. This decentralization means no single person or entity can secretly alter the records or control the whole system.

Then there's immutability. This just means that once a transaction is added to the ledger, it’s set in stone. It can't be changed or deleted. Each block is sealed using cryptography, making the entire financial history tamper-proof. You end up with a level of trust and integrity baked right into your financial data. This structure even simplifies complex tasks, like building out a complete chart of accounts guide for all your digital assets.

The Rise of Triple-Entry Bookkeeping

For over 500 years, double-entry bookkeeping has been the standard. For every transaction, a debit is recorded in one account and a credit in another, all within a company's private books. Blockchain is ushering in the next big evolution: triple-entry bookkeeping.

In a triple-entry system, a third entry is created for every transaction. This entry is cryptographically sealed and recorded on the shared blockchain ledger, acting as a permanent, verifiable receipt for both parties involved.

This third entry creates an undeniable link between the buyer’s books and the seller’s. The practical benefits for accountants and business owners are massive.

Here's a quick look at how the old and new methods stack up.

Traditional Accounting vs Blockchain Accounting

| Feature | Traditional Accounting (Double-Entry) | Blockchain Accounting (Triple-Entry) |

|---|---|---|

| Trust | Relies on trust between parties and audits | Trust is built into the system (cryptographically verified) |

| Ledger | Separate, private ledgers for each entity | A single, shared, and distributed ledger |

| Verification | Requires manual reconciliation and external audits | Transactions are verified and reconciled in real-time |

| Record Integrity | Records can be altered or deleted (subject to controls) | Records are immutable and cannot be changed once added |

| Transparency | Limited; records are internal and private | High; all authorized parties can view transactions |

This comparison highlights why triple-entry is such a big deal. It's not just a minor upgrade.

The implications are clear and immediate:

- Automated Reconciliation: Since both ledgers are tied to the exact same verified transaction on the blockchain, the tedious work of manual reconciliation practically vanishes.

- Enhanced Audit Trails: Auditors can get direct access to a permanent, time-stamped record of every single transaction. This makes the entire audit process faster, cheaper, and far more accurate.

- Reduced Fraud: The transparent and unchangeable nature of the ledger makes it incredibly difficult for anyone to cook the books or commit financial fraud.

This isn't just about recording history anymore. It's about creating a single, verifiable, real-time source of financial truth.

The Real-World Impact on Your Financial Statements

It’s one thing to talk about immutable ledgers and decentralized finance, but it’s another to see how it all plays out on your company’s actual financial reports. If your small business is starting to work with crypto—maybe accepting it for payments or holding it as an investment—you absolutely need to understand how it hits your books. This isn't just good practice; it’s essential for staying compliant and truly knowing your numbers.

The old way of doing things just wasn't cutting it. For years, businesses recorded crypto at its original purchase price (historical cost). That meant its value on your balance sheet stayed frozen unless you sold it or its value permanently tanked. This approach created a huge disconnect between what your books said an asset was worth and its actual market value, painting a pretty misleading picture of your financial health.

The New Standard: Fair Value Accounting

Thankfully, the rule-makers caught up. The Financial Accounting Standards Board (FASB) rolled out a major update that completely changes the game. Now, businesses are required to measure their crypto holdings at fair value at the end of each reporting period. Any fluctuation in value—up or down—gets recorded directly in your net income.

This is a big deal. It moves us away from the outdated historical cost method and provides investors and owners with a much more transparent view of what’s going on. You can get a more technical look at the future of digital asset reporting to see just how deep these changes go.

The bottom line? The wild swings of the crypto market can now directly impact your company's reported profitability, quarter by quarter.

Key Takeaway: With fair value accounting, the changing price of assets like Bitcoin or Ethereum creates real gains or losses on your income statement—even if you haven’t sold a thing.

Let's walk through a quick example to make this crystal clear.

A Practical Example of Crypto on Your Books

Imagine your graphic design agency accepts 1 Bitcoin (BTC) for a big project. On that day, Bitcoin is trading at $60,000. Here’s how that single transaction ripples through your financial statements under the new rules.

At the Time of Transaction (Q1):

- On your balance sheet, you now have a digital asset worth $60,000.

- On your income statement, you recognize $60,000 in service revenue. Simple enough.

At the End of the Quarter (Q2):

Let's fast forward a few months. The price of Bitcoin has shot up to $70,000.

- You now have to adjust, or "mark-to-market," the value of your Bitcoin on the balance sheet to $70,000.

- Here’s the critical part: you also report a $10,000 unrealized gain on your Q2 income statement.

That $10,000 gain boosts your net income for the quarter, making your business look more profitable, even though you’re still holding the Bitcoin. Of course, this cuts both ways. If the price had dropped to $55,000, you’d have to book a $5,000 unrealized loss, dragging your net income down.

This direct line from market volatility to your bottom line makes careful, continuous tracking a must. The financial story your business tells—to lenders, investors, and yourself—is now tied to the real-time value of your digital assets. This is why having a rock-solid understanding of your profit and loss statements is more crucial than ever. It ensures you’re making decisions based on a complete and honest financial picture.

Taking Your Business Automation to the Next Level with Smart Contracts and Tokenization

Beyond just being a super-secure ledger, blockchain gives us some incredible tools that can automate complex business deals. Two of the biggest game-changers are smart contracts and tokenization. These aren't just buzzwords; they’re what turn the blockchain from a passive record-keeper into an active, automated partner in your business.

Think of a smart contract as a vending machine for agreements. You code the rules of your deal—"if this happens, then do that"—and put it on the blockchain. Once it's live, the contract runs itself. It automatically executes the terms as soon as the conditions are met. No need for a middleman, no chasing people down. The code is the law.

For an accountant, this is huge. It means fewer manual checks and painful reconciliations because the contract’s execution is the proof. It’s an undeniable, automated record of exactly what happened and when.

How Smart Contracts Actually Play Out

So, how does this look in the real world for a small business? Smart contracts are perfect for handling those repetitive, rule-based jobs, which frees up your time and slashes the risk of human error. They bring a level of efficiency that used to be out of reach without a ton of administrative help.

Let’s take a freelance graphic designer working with a new client. Instead of sending invoices and hoping for the best, they could set up a smart contract. The terms are simple:

- The "If": The client digitally approves the final design files.

- The "Then": The smart contract instantly sends the pre-loaded payment from the client’s wallet to the designer’s.

The whole thing is instant and completely transparent. The designer gets paid the second the work is approved, which is a massive win for cash flow. The client is happy knowing their money is only released when they get what they paid for. It builds trust right from the start.

From a bookkeeping perspective, that smart contract firing off is your verifiable, time-stamped trigger. It's the event that lets you recognize revenue and the cash receipt, and since it’s on the blockchain, you have a perfect audit trail baked right in.

Here are a few other places this works beautifully:

- Paying Suppliers: A contract could pay a supplier the moment a shipping manifest confirms a delivery has arrived. No more "net 30" delays.

- Subscription Models: A business can collect monthly fees automatically, without needing a third-party processor, as long as the customer’s service is active.

- Royalty Payouts: A musician could get their cut the instant their song is streamed, or an author could get paid the second their e-book is sold.

Unlocking New Value with Tokenization

If smart contracts automate your processes, tokenization changes how you handle your assets.

Tokenization is simply the process of converting ownership rights of an asset into a digital token on the blockchain. You can tokenize just about anything—a piece of real estate, a vintage car, or even a share in your private company.

Imagine a local brewery wants to expand. The traditional route of selling equity is a legal and financial nightmare. But with tokenization, they could issue digital tokens, where each one represents a tiny slice of ownership.

Suddenly, an illiquid asset becomes easy to buy, sell, or trade. Someone could invest by buying a token representing just 0.01% of the brewery. That kind of fractional ownership is basically impossible to manage with old-school paper stock certificates.

The Accounting Side of Tokenized Assets

For accountants, tokenization brings both new opportunities and new things to learn. It creates a crystal-clear, verifiable record of who owns what, which makes managing a company’s cap table or paying out dividends way simpler.

For small businesses, this opens up more creative ways to raise capital. Instead of one huge bank loan, a company could tokenize future revenue streams or even physical equipment. Each token acts as a digital piece of collateral, all tracked securely on the blockchain. This intersection of blockchain and accounting gives businesses a whole new way to fund their growth by making their assets more divisible and easier to transfer than ever before.

Navigating Crypto Tax Reporting and IRS Compliance

If your business is involved with digital assets, you already know tax season can get… complicated. The main reason? The Internal Revenue Service (IRS) doesn't see cryptocurrency as money. Instead, it treats every coin and token as property.

That single classification changes everything. Suddenly, simple actions become taxable events. Selling crypto, trading one token for another, or even paying for a service with Bitcoin—each one triggers a potential tax bill. And the burden of tracking it all falls squarely on your shoulders. With regulations getting stricter every year, simply hoping for the best isn't a strategy.

It All Starts With Cost Basis

The entire world of crypto taxes revolves around one core concept: cost basis. Think of it as the total price tag for acquiring an asset. It includes the purchase price plus any transaction fees you paid. When you eventually sell or trade that crypto, you calculate your capital gain or loss by subtracting the cost basis from your sale price.

Sounds easy enough, right? But what if you bought Bitcoin ten different times at ten different prices? When you sell, which purchase price do you use? This is where things get tricky, and choosing the right accounting method becomes absolutely essential for accurate—and optimized—tax reporting.

Key Takeaway: Without a precise record of your cost basis for every single crypto asset, you're flying blind. You can't accurately calculate your gains or losses, which could lead to a massive tax overpayment or, even worse, an IRS audit.

This is precisely why anyone serious about blockchain and accounting needs specialized software. It’s no longer just a nice-to-have.

Reporting on IRS Form 8949

All that meticulous tracking has one final destination: IRS Form 8949, "Sales and Other Dispositions of Capital Assets." This is where you have to line-item every single crypto transaction.

For each trade, sale, or spend, you must report:

- When you acquired the asset

- When you sold or disposed of it

- How much you received for it (the proceeds)

- Your original cost basis

- The final capital gain or loss

The totals from Form 8949 then flow into Schedule D of your main tax return. If your business has hundreds or thousands of transactions, trying to fill this out by hand is a nightmare waiting to happen. For a deeper look, check out our complete guide to IRS crypto tax rules.

The Stablecoin Tax Trap

One of the most common—and costly—misconceptions I see involves stablecoins like USDT and USDC. Because they’re pegged to the U.S. dollar, people assume trading with them has no tax impact. That’s dead wrong.

From the IRS’s point of view, swapping your Bitcoin for USDC is identical to swapping it for cash. It’s a sale of property, and it’s a taxable event.

Stablecoins are incredibly popular for everyday business uses like payroll and payments, but each time you use them, you’re likely creating a tiny capital gain or loss that must be reported. According to a 2025 report on crypto adoption, their transaction volume has skyrocketed, meaning this accounting headache is only getting bigger.

Tools Like Koinly Make This Manageable

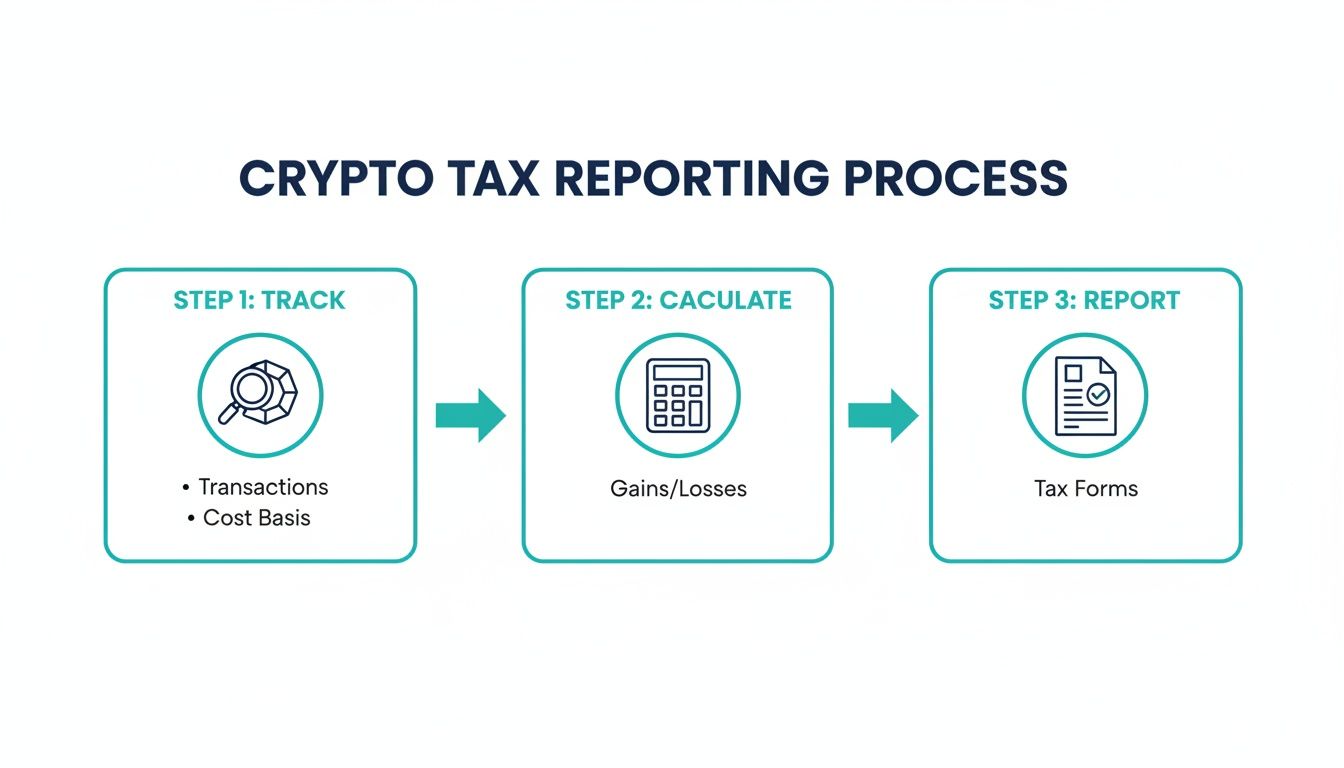

Thankfully, we have technology to solve this problem. Platforms like Koinly are built specifically to automate this entire painful process. You just connect your exchange accounts and wallet addresses, and it pulls in your entire transaction history automatically.

From there, the software does the heavy lifting. It matches your buys and sells, calculates the cost basis for every transaction, and spits out your exact capital gains and losses. The dashboard gives you a clear, ongoing picture of your tax liability.

The best part? It generates a completed, audit-ready Form 8949 that you can hand right over to your accountant. Using a tool like this doesn't just save you dozens of hours; it brings a level of accuracy to your reporting that’s nearly impossible to achieve manually.

A Practical Workflow for Managing Crypto Transactions

Alright, let's get down to brass tacks. Theory is great, but building a reliable, repeatable process for handling your business’s cryptocurrency transactions is where the real work begins. If you're manually tracking every buy, sell, and trade across multiple exchanges and wallets, you’re not just being inefficient—you're setting yourself up for a world of pain come tax time. A structured workflow isn't a "nice-to-have"; it's essential.

The whole process starts with getting all your data in one place. You need a central hub that connects to everything—your Coinbase account, your Kraken exchange, that MetaMask wallet you use for DeFi—and pulls every single transaction into one dashboard. This is step one. It eliminates tedious data entry and gives you a single source of truth for all your crypto activity, which is the bedrock of accurate bookkeeping.

Step 1: Consolidate and Categorize Your Data

This is where specialized software becomes your best friend. Tools like Koinly are built specifically for this job. You link your accounts using secure API keys or simply by adding your public wallet addresses, and the platform automatically imports thousands of transactions in minutes.

But here’s where it gets really good. Once the data is in, the software starts sorting it all out for you. It knows the difference between:

- Buys and Sells: Simple crypto-for-cash transactions.

- Crypto-to-Crypto Trades: Swapping one coin for another, which the IRS sees as a taxable event.

- Income: Getting paid in crypto for your services.

- Transfers: Moving funds between your own wallets (not taxable, but needs to be tracked!).

This kind of smart categorization saves an incredible amount of time and, more importantly, keeps you from misclassifying a transaction and creating a tax nightmare down the line.

Step 2: Reconcile and Generate Reports

With all your transactions neatly imported and categorized, the next move is reconciliation. The software crunches the numbers, calculating the cost basis for every asset you hold and figuring out the capital gain or loss for each taxable event. From there, it generates the reports you actually need, including the all-important IRS Form 8949, ready to hand over to your accountant.

This simple flow is how you turn chaos into order. You track, calculate, and then report.

What was once a complex, error-prone mess becomes a manageable system that keeps you accurate and compliant. That final report is your bridge back to the world of traditional accounting.

Step 3: Integrate with Your Accounting Software

The end goal is to get this clean, reconciled crypto data into your main accounting software, like QuickBooks Online. This is the step that gives you a complete financial picture of your business, blending your traditional finances with your digital asset activities.

A well-structured workflow ensures that your crypto transaction data is not just collected but is fully integrated into your general ledger. This means your financial statements—like your profit and loss or balance sheet—accurately reflect the impact of your digital assets.

Once this data flows into QuickBooks Online, you can stop looking at your finances in silos and start managing your business with a truly holistic view of its financial health. You can learn more about how to efficiently import transactions into QuickBooks Online to make this final step even smoother.

Step 4: Establish Strong Internal Controls

Finally, a solid workflow needs good habits to back it up. Strong internal controls are what keep your data clean and secure over the long haul. These aren't one-off tasks; they’re ongoing practices.

- Perform Regular Reconciliations: At least once a month, you should be comparing the balances in your crypto software against the actual balances in your wallets and exchanges. This is how you catch discrepancies before they become big problems.

- Maintain Separate Wallets: This is non-negotiable. Never, ever mix business and personal crypto funds. Use dedicated wallets for all business activities to simplify tracking and maintain your company’s legal separation.

- Document Your Processes: Write it down. Create a clear, simple policy for how your company handles crypto transactions, from receipt to reporting. This ensures everyone is on the same page and keeps things consistent as your team grows.

By combining the right software with disciplined internal processes, you create a robust system that makes managing crypto transactions accurate, compliant, and ready to scale with your business.

Finding the Right Partner for Your Blockchain Accounting

Even with the best software, crypto accounting can get tricky. These tools are fantastic for pulling in data, but they can't always make sense of the complex world of blockchain on their own. This is where bringing in a human expert becomes less of a luxury and more of a necessity.

Think of it this way: your crypto software is the high-performance engine, but an experienced bookkeeper is the skilled driver. They know how to navigate the tricky turns of compliance and accounting principles that are unique to digital assets. They’ll set up a solid system from the start to make sure every single transaction is recorded correctly.

Why You Shouldn't Go It Alone

Trying to manage your crypto books without specialized help is a bit of a gamble. You could end up with messy financial reports, pay way more in taxes than you need to, or even face penalties for non-compliance. A pro who lives and breathes this stuff takes that risk off your plate.

Their job is to provide consistent, knowledgeable oversight. This means you get audit-ready financial statements you can hand over to a lender, an investor, or the IRS without breaking a sweat.

It’s about more than just avoiding trouble, though. A good partner reconciles your books every month, catching small errors before they become massive headaches. They know how to properly account for things like staking rewards, airdrops, and DeFi loans—all of which have their own specific tax rules.

Outsourcing isn't just about offloading tasks. It's about bringing on a strategic ally who handles the financial complexities so you can pour your energy back into what you do best: running your business.

What to Look for in a Blockchain Accounting Partner

When you're ready to find help, you need a firm that goes beyond basic data entry. The right partner will guide you in building a financial system that's both compliant today and ready to grow with you tomorrow.

Here are a few things an expert firm should handle for you:

- System Setup and Integration: They’ll help you choose the right tools, like Koinly, and make sure it talks perfectly to your main accounting software, like QuickBooks Online.

- Monthly Reconciliation: They will regularly match your wallet and exchange data to your books, guaranteeing everything is accurate and accounted for.

- Audit-Ready Financials: Your partner will produce clean, clear financial statements that properly reflect the value of your digital assets every single month.

- Tax Prep Support: They'll take on the tedious work of calculating your cost basis and generating a complete Form 8949, which makes tax time a whole lot smoother.

Ultimately, the goal is to create a financial foundation you can completely trust. When you learn more about the benefits of outsourced bookkeeping for small businesses, you'll see how professional support delivers the peace of mind you need to scale your business with confidence.

A Few Common Questions About Blockchain and Accounting

When you start digging into how blockchain fits into your business finances, a lot of questions pop up. It’s a new frontier for many, so let's tackle a few of the most common ones we hear from business owners.

What Is the Real Cost to Implement Blockchain Accounting?

It's easy to focus on the software license, but that's just one piece of the puzzle. The upfront costs usually involve bringing in an expert to help design a system that actually works for your business, training your team on new processes, and paying for the technical work to get new tools talking to your existing software like QuickBooks Online.

But you have to look at the other side of the coin. The long-term savings can be massive. Think about the time saved with automated reconciliations, the money protected from reduced fraud, and the smoother, faster audits. It’s less of a pure expense and more of a strategic upgrade to your entire financial backbone.

Can Blockchain Completely Replace Accountants?

Absolutely not. This is probably the biggest myth out there. Blockchain is fantastic at automating the repetitive, manual tasks—the data entry, the transaction matching—but it can't replicate professional judgment or strategic thinking. It’s a powerful tool for an accountant, not a replacement.

Accountants are still critical for the human element:

- Making sense of the numbers and turning that data into smart business advice.

- Staying on top of compliance as tax laws and accounting standards scramble to keep up.

- Solving the weird problems and untangling the exceptions that automated systems inevitably miss.

- Designing and monitoring the internal controls that make the whole system trustworthy.

Think of it this way: blockchain frees up accountants from the drudgery. It lets them step away from the calculator and focus on the high-level advisory work that actually helps a business grow. The technology elevates the profession, it doesn't erase it.

I Want to Accept Crypto. What Is My First Step?

Hold on before you accept that first Bitcoin or Ethereum payment. The single most important thing is to have a solid tracking system in place before any money (or crypto) changes hands. Just letting payments land in a random wallet is a surefire way to create a compliance nightmare for yourself down the road.

Your very first step is to set up a dedicated business wallet. Never, ever mix personal and business crypto funds. Next, pick a reputable crypto tax and portfolio tracker, like Koinly, and get it configured to automatically pull in your transaction data. This gives you a clean, unbroken record from day one, which is the foundation for accurate blockchain and accounting and stress-free tax filing.

Navigating the world of digital asset bookkeeping isn't something you should have to figure out alone. At Bugaboo Bookkeeping, we specialize in helping businesses and investors integrate their crypto activity seamlessly, ensuring your books are accurate, compliant, and always ready for scrutiny. Schedule your free consultation today to get started.