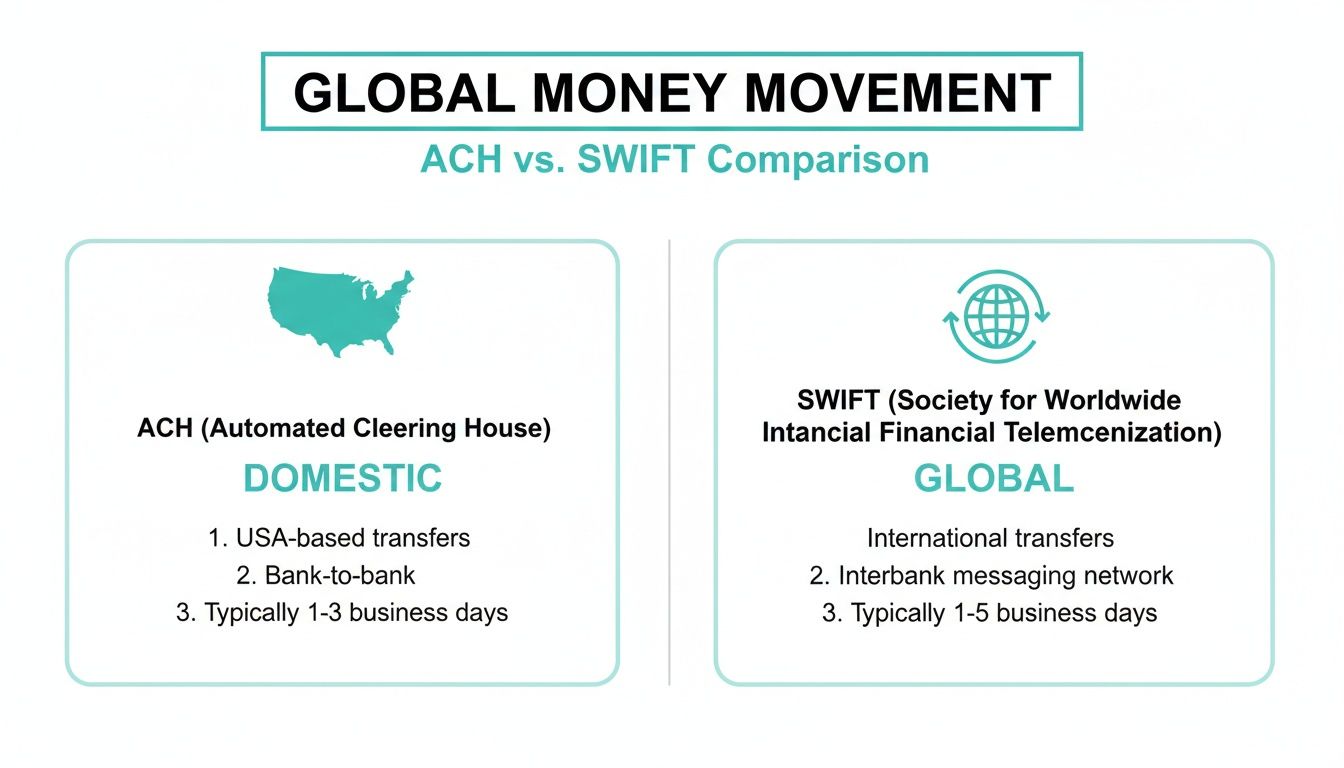

At its core, the choice between ACH and SWIFT boils down to one simple question: where is the money going?

If you're paying someone within the United States, you'll want to use ACH, the domestic network built for everyday, low-cost payments like payroll and bills. But if you need to send money to another country, your only real option is SWIFT, the global system designed for international bank transfers. It’s that fundamental difference in geography that dictates everything else, from speed and cost to complexity.

Decoding the Payment Rails

When you send or receive money, it doesn’t just magically appear. It travels along established financial networks, often called "payment rails." For a small business, getting a handle on the two main rails—ACH and SWIFT—is crucial for managing your cash flow, keeping costs down, and just generally running a tighter ship. They both move money, but they were built for completely different purposes.

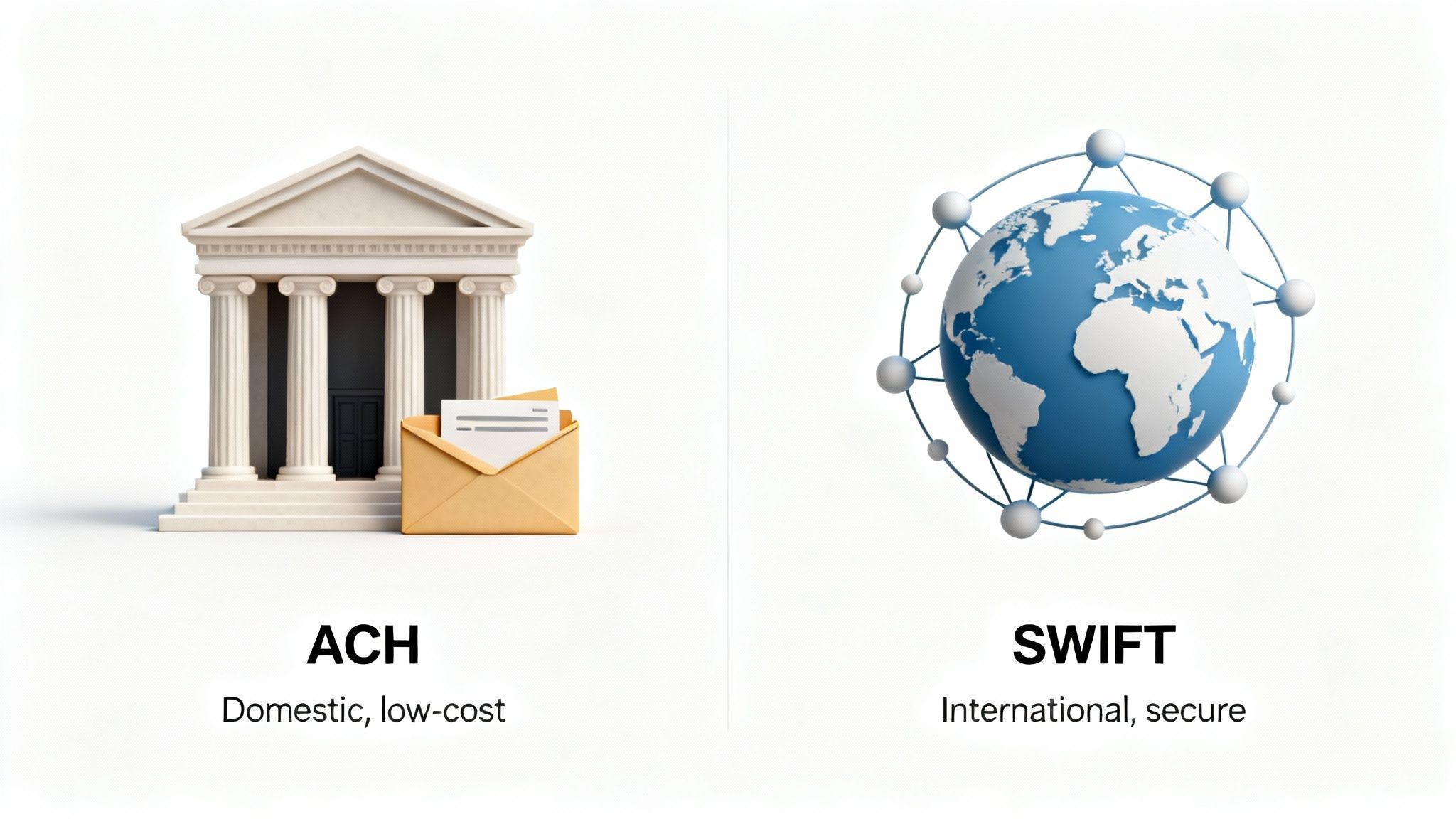

A good way to think about it is to compare them to shipping methods.

The ACH network is like a domestic freight train system. It’s reliable, incredibly cheap, and perfect for moving lots of routine payments between U.S. cities. It runs on a set schedule, bundling transactions into batches to keep things efficient and affordable for everyone involved. Think payroll, vendor payments, and customer debits.

The SWIFT network, on the other hand, is more like international air freight. It’s the global standard for connecting banks across borders, making it the go-to for sending larger sums of money overseas. But just like international shipping, the process involves more steps, more handlers (intermediary banks), and more compliance checks, which naturally makes it slower and more expensive.

This visual gives you a quick side-by-side look at how these two systems stack up.

As you can see, the destination of your payment is the first and most important filter. Getting this choice right from the start saves a lot of headaches.

The rule of thumb for any business owner is straightforward: Use ACH for everything you can within the U.S. and reserve SWIFT for when you have no other choice but to send funds internationally. Using the wrong rail leads to wasted money, frustrating delays, and a mess of paperwork.

Before we get into the nitty-gritty of costs, speed, and security, here’s a quick-glance table that lays out the most important distinctions. This sets the stage for a deeper dive into what these differences mean for your day-to-day operations.

Key Differences Between ACH and SWIFT Payments

| Feature | ACH (Automated Clearing House) | SWIFT (Society for Worldwide Interbank Financial Telecommunication) |

|---|---|---|

| Geographic Scope | Primarily domestic within the United States. | Global, connecting banks in over 200 countries. |

| Primary Use Case | High-volume, low-value recurring payments like payroll, direct deposit, and bill payments. | High-value, low-volume, one-off international transfers like paying foreign suppliers. |

| Transaction Speed | 1-3 business days; Same-Day ACH options are available for faster settlement. | 1-5 business days, often longer due to time zones and intermediary banks. |

| Cost Structure | Very low cost, often ranging from a few cents to under a dollar per transaction. | High cost, typically $20-$50 per transfer, plus potential fees from intermediary banks. |

| How it Works | A batch-processing network that groups payments and processes them at set times. | A secure messaging system that sends payment instructions between correspondent banks. |

This table captures the high-level trade-offs, but as we'll explore next, the real impact is felt in your bank account and your bookkeeping.

How the ACH Network Powers Domestic Payments

The Automated Clearing House (ACH) network is the workhorse behind most of the electronic payments you see in the United States. Think of it less like a race car and more like a freight train—it’s not designed for the blistering speed of a single transaction, but for moving massive volumes of payments with incredible efficiency and at a very low cost. It’s the system that powers everything from your direct deposit paycheck to your automatic monthly utility bill.

Unlike a wire transfer that sends a single payment in near real-time, ACH uses a batch-processing model. Throughout the day, it collects payment instructions from thousands of banks, bundles them together, and processes them at specific times. This is the secret sauce that keeps the cost per transaction down to just pennies.

Understanding ACH Credits and Debits

On the ACH network, every transaction is either a "push" or a "pull." For a small business, knowing the difference is key to managing cash flow.

-

ACH Direct Deposit (Credits): These are "push" transactions, where you send money out. The classic example is payroll—your company pushes funds into your employees' bank accounts. Paying vendors or sending tax refunds also fall into this category.

-

ACH Direct Payment (Debits): These are "pull" transactions, where you’re authorized to take money from a customer's account. This is how recurring payments for things like gym memberships, software subscriptions, or mortgage payments work. It’s a great way to automate your receivables.

This push-and-pull system makes ACH an incredibly versatile tool for handling both money coming in and money going out, all within the U.S.

The Lifecycle of an ACH Transaction

To really get a feel for ACH, it helps to see how a payment moves from point A to point B. It’s a multi-step dance between two main players: the ODFI (your bank) and the RDFI (the recipient’s bank).

- Origination: It starts with you, the business (Originator). You create a file with all the payment details—routing numbers, account numbers, amounts—and send it to your bank, the Originating Depository Financial Institution (ODFI).

- Batching and Submission: Your bank bundles your payment file with countless others and sends the whole batch to an ACH Operator, which is either the Federal Reserve or The Clearing House.

- Sorting and Distribution: The ACH Operator acts like a central sorting facility, breaking up the batches and forwarding the payment instructions to the correct Receiving Depository Financial Institution (RDFI)—the bank on the other end.

- Settlement: The RDFI credits or debits the recipient's account. Finally, the Fed settles the transaction between the two banks behind the scenes.

The sheer scale here is hard to wrap your head around. The ACH network has been around since the 1970s, but its growth is explosive. In a single recent quarter, the network processed 8.8 billion payments worth a staggering $23.2 trillion. That really drives home just how critical it is to the U.S. economy.

This reliable, high-volume process is why ACH is the go-to for domestic payments. When you put ACH vs SWIFT side-by-side, it’s clear SWIFT was never built for this kind of low-cost, domestic bulk work. From a bookkeeping perspective, ACH is also fairly straightforward. Still, it’s always a good idea to know the best ways to import transactions into QuickBooks Online to keep your books accurate and clean.

Understanding SWIFT for Global Business Transactions

When your business needs to send money across borders, the domestic-focused ACH network simply won’t cut it. This is where the SWIFT network—the Society for Worldwide Interbank Financial Telecommunication—steps in. It’s the powerhouse of global finance, but there's a common misunderstanding about what it actually does.

Here's the key thing to grasp: SWIFT isn't a payment system. It doesn't hold or transfer any funds itself. Instead, it’s a highly secure messaging network. Think of it as the global courier service for banks, zipping standardized and encrypted payment instructions from one financial institution to another across the globe.

This distinction is crucial when comparing ACH vs SWIFT. ACH is a centralized clearinghouse that processes batches of domestic payments. SWIFT, on the other hand, facilitates one-to-one communication for international transactions, creating a fundamentally different process from start to finish.

The Correspondent Banking Chain

To get money from point A to point B internationally, a SWIFT message often has to hop through a chain of correspondent banks. Let's say your bank in Washington doesn't have a direct relationship with your supplier's bank in Germany. The payment instruction gets relayed through one or more intermediary banks that have relationships with both ends of the transaction.

This multi-step journey is precisely why SWIFT transfers are slower and more expensive. Each bank in that chain performs its own compliance checks and, you guessed it, charges a fee for its part.

- Time Delays: Every stop adds time. When you factor in different time zones and business hours, a SWIFT transfer typically takes one to five business days to finally settle.

- Variable Costs: Fees are nipped away at each step. This means the $20 to $50 upfront fee your bank charges is just the beginning. The final amount your recipient gets can be less than what you originally sent, which can cause real headaches.

The core trade-off with SWIFT is its unmatched reach for the price of complexity. It connects over 11,000 financial institutions in more than 200 countries, making it the indispensable standard for global trade, despite its higher costs and slower settlement times. You can explore more about SWIFT's global financial messaging system to see its operational details.

This unpredictability in final cost and settlement date is a significant challenge for small businesses trying to manage their finances. These variables can throw a wrench in your financial forecasting, and you can get more details on why that matters in our guide to understanding cash flow statements.

Indispensable for International Trade

Even with its drawbacks, SWIFT remains the backbone of international commerce. There's a reason it has stuck around. Its robust security protocols and universal acceptance make it the only reliable option for certain high-stakes transactions.

For a Washington-based business, SWIFT is the go-to tool for:

- Paying an overseas supplier for a large inventory order.

- Receiving a significant payment from an international client.

- Making a one-time, high-value purchase of foreign equipment or assets.

In these scenarios, the security and global acceptance of the SWIFT network easily outweigh the downsides of its speed and cost. It provides a trusted, albeit complex, pathway for moving money anywhere in the world—a feat no other system can reliably accomplish on such a massive scale.

When it comes to moving money, the choice between ACH and SWIFT often boils down to three critical things: speed, cost, and security. On the surface, they both get the job done, but digging into the details reveals two completely different worlds. How you choose between them directly hits your cash flow, your profit margins, and your business's risk exposure.

Think of it this way: ACH was built for domestic efficiency, while SWIFT was designed for global reach. Understanding how they operate behind the scenes is the key to picking the right tool for the right payment.

How Transaction Speed Differs

The first thing you'll notice is how long it takes for the money to actually arrive. ACH used to have a reputation for being a bit slow, but that’s changed. While a standard transfer still takes 1-3 business days to settle, the game-changer has been Same-Day ACH. If you get your payment submitted before the cutoff times, the funds can clear the very same day—perfect for those last-minute payroll runs or urgent vendor payments.

SWIFT, on the other hand, is a different story. An international wire transfer typically takes anywhere from 1-5 business days, and that’s if everything goes smoothly. Delays are almost a built-in feature of the system because the payment has to hop between several correspondent banks to reach its final destination.

Here’s what can slow a SWIFT payment to a crawl:

- Time Zone Differences: A payment sent from Washington at the end of your day might not even be looked at by a bank in Europe until their next business day begins.

- Bank Holidays: A national holiday in the recipient's country can easily add a day or more to the transfer time.

- Compliance Checks: Every single bank in the chain has to run its own anti-money laundering (AML) and sanctions screening. Any little flag can bring the whole process to a halt while they investigate.

The real difference in speed isn't just about network technology; it's about the journey. An ACH payment is like a direct domestic flight with a predictable arrival. A SWIFT payment is more like an international flight with multiple layovers, and each stop introduces a new chance for delay.

The True Cost of a Transaction

This is where the differences become impossible to ignore. ACH is, by design, incredibly affordable. Most businesses pay well under a dollar for each transaction, sometimes just a few cents. For any kind of high-volume or recurring domestic payment, it’s the undisputed champion of cost-effectiveness.

SWIFT fees are a tangled mess. The cost structure is layered, complex, and often frustratingly opaque.

SWIFT Fee Breakdown

- Initiation Fee: Your bank will charge you right out of the gate, usually somewhere between $20 and $50, just to start the transfer.

- Intermediary Bank Fees: Each bank that touches the money along the way will shave off its own fee from the total amount. You often have no idea this is even happening until the recipient gets less than you sent.

- FX Conversion Spreads: This is the hidden cost. When currencies are exchanged, banks build a markup into the exchange rate they offer you. On large transfers, this can easily become the most expensive part of the transaction.

This combination of fees means the final amount your supplier receives is often a mystery. This can cause major reconciliation headaches and even strain your vendor relationships. It’s a prime example of why a solid grasp of concepts like the difference between accounts payable vs accounts receivable is so crucial for any business dealing with international payments.

Comparing Security and Risk Profiles

Both networks are incredibly secure, but they’re built to guard against very different kinds of threats.

ACH security is dictated by a strict set of operating rules from Nacha (National Automated Clearing House Association). This creates a tightly regulated, closed-loop system designed to stamp out domestic fraud. The main risks are things like unauthorized withdrawals or simple transaction errors, and Nacha’s rules provide a clear process for reversing and fixing them.

SWIFT’s security is all about authenticating messages and protecting data as it moves across a massive, decentralized global network. The protocols are there to make sure the payment instructions sent from one bank to another are legitimate and haven't been tampered with. The risks aren't small-time fraud; they're major cybersecurity threats and the enormous challenge of navigating international compliance, like staying clear of OFAC sanctions lists.

In-Depth Feature Analysis of ACH vs SWIFT

To really see how these differences play out for a small business, it helps to put them side-by-side. The table below breaks down the practical implications of each network's features.

| Comparison Point | ACH Analysis | SWIFT Analysis | Key Takeaway for Businesses |

|---|---|---|---|

| Transaction Speed | 1-3 days for standard, with Same-Day options available. Highly predictable. | 1-5+ business days. Vulnerable to delays from time zones and intermediary banks. | Use Same-Day ACH for urgent domestic needs. For SWIFT, always build in a buffer for potential delays. |

| Typical Cost | Extremely low, usually $0.20 – $1.50 per transaction. Very predictable. | High, starting at $20 – $50 plus opaque intermediary fees and FX markups. | ACH is your go-to for cost control. For SWIFT, you have to budget for unknown fees eating into your total. |

| Security Focus | Governed by Nacha rules to prevent domestic fraud, errors, and unauthorized debits. | Secure messaging protocols ensure instruction integrity across a decentralized global network. | With ACH, the risk is mostly operational (errors). With SWIFT, the risks are geopolitical and compliance-based. |

Ultimately, choosing the right rail requires you to look beyond the simple act of sending money and consider the entire context of the payment—where it's going, how quickly it needs to get there, and how much you're willing to pay in both visible and hidden fees.

Practical Use Cases for Your Small Business

Knowing the technical specs of ACH and SWIFT is one thing, but knowing when to use each one is what really hits your bottom line. Pick the right payment rail for the right job, and you'll save money, get paid faster, and keep your vendors and employees happy. Let's move from theory to the real-world scenarios you face every day.

Think of it this way: ACH and SWIFT are specialized tools in your financial toolkit. You wouldn't use a sledgehammer to hang a picture frame, right? In the same vein, using SWIFT to run your local payroll is a classic case of overkill—and an expensive one at that.

When to Use the ACH Network

For almost any routine payment that stays within the United States, the ACH network is your workhorse. It’s cheap, reliable, and perfectly designed for high-volume, predictable transactions. If the money isn't crossing a U.S. border, ACH should always be your default choice.

Here’s where it shines for a Washington-based small business:

- Paying U.S. Employees and Contractors: Running weekly or bi-weekly payroll? ACH Direct Deposit is the gold standard. It’s affordable, dependable, and ensures your team gets paid on time, every time, without anyone having to deal with paper checks.

- Collecting Recurring Customer Payments: If you run a subscription service, manage a gym, or have any model with regular billing, ACH Direct Debit is a game-changer. It automates your collections, makes your cash flow predictable, and costs a fraction of what you'd pay in credit card processing fees.

- Paying Domestic Vendors and Suppliers: For all those regular invoices from your U.S.-based suppliers, ACH is simply the smartest, most cost-effective way to pay. Why spend $25 on a wire fee when an ACH transfer often costs less than a dollar?

- Making State and Federal Tax Payments: Government agencies are all-in on ACH. Whether you're paying the IRS or the Washington State Department of Revenue for your B&O taxes, they are set up to receive ACH payments easily.

Key Insight: The common thread here is simple: domestic and recurring. The ACH system was built from the ground up for predictable, low-cost U.S. transactions, making it the engine of your day-to-day financial operations.

When to Use the SWIFT Network

Save SWIFT for one thing and one thing only: international transactions. Yes, it’s more expensive and often slower, but it’s the only universally accepted and secure way to move money across borders through the traditional banking system. Trying to force a domestic payment through SWIFT is just throwing money away.

Here are a few real-world situations where SWIFT is the only tool for the job:

- Paying an Overseas Supplier: You've sourced amazing inventory from a supplier in Vietnam. To pay their invoice, your bank will need to initiate a SWIFT transfer, sending U.S. Dollars that will eventually be converted into Vietnamese Dong on their end.

- Receiving Payment from an International Client: A customer in the United Kingdom owes you for a $10,000 invoice. They will instruct their British bank to use the SWIFT network to send the funds to your bank right here in Washington.

- Making a Large, One-Time Foreign Investment: Let's say your business is buying a piece of specialized manufacturing equipment from a German company. A SWIFT transfer provides the robust security and paper trail required for such a high-value, cross-border purchase.

In any of these cases, ACH simply isn't an option. Geography makes the choice for you. While SWIFT does bring complexities like correspondent bank fees and currency conversions, it's the essential bridge connecting your business to the global marketplace. Managing these payments well is crucial, which is why solid accounts receivable best practices are so important for any business with an international footprint.

Accounting and Compliance: The Hidden Costs

Deciding between ACH and SWIFT goes far beyond just moving money. It’s a choice that directly impacts how much time you spend on bookkeeping and how much risk you take on. The simple, clean nature of one network stands in stark contrast to the administrative tangle of the other, making this a critical part of the ACH vs SWIFT conversation for any small business.

If you're using accounting software like QuickBooks Online, handling ACH payments is a breeze. The amount you send is exactly what's debited from your bank account, and the fee shows up as a separate, predictable transaction.

Bank reconciliation couldn't be easier. Let’s say you pay a $500 vendor invoice and your bank charges a $0.50 ACH fee. Your bank feed will show two distinct entries that you can match up in seconds. This kind of predictability is exactly what you want for a smooth accounts payable workflow.

The SWIFT Accounting Puzzle

SWIFT payments, on the other hand, can create a real accounting headache. Because of intermediary bank fees and fluctuating foreign exchange (FX) rates, the final amount your international supplier receives is almost never what you originally sent.

This opens up a can of worms for your bookkeeper:

- Mysterious Fees: Intermediary banks take their cut directly from the payment itself, meaning you won't know the exact fee until the transaction is complete. You’ll have to create separate journal entries for these unexpected bank charges.

- Reconciliation Nightmares: Your supplier gets a payment that's short of the full invoice amount, creating a partial payment on their end. This forces you to communicate back and forth to manually adjust records and close the invoice.

- FX Gains and Losses: Paying in a different currency means the exchange rate can shift between the day you enter the bill and the day the payment actually settles. This difference has to be recorded on your income statement as either a foreign exchange gain or loss.

A SWIFT payment isn't just one transaction to record; it's a multi-step reconciliation challenge. You're juggling the core payment, the hidden fees, and the currency conversion, turning what should be simple into a time-consuming task.

Getting a handle on these moving parts is key to a functional payables system. You can dive deeper into this in our guide to the accounts payable process.

Navigating Two Different Worlds of Compliance

Beyond the books, the compliance rules for each network are worlds apart. ACH operates entirely within the U.S. under the regulations of Nacha. The rules are strict, but they're domestic, and your bank handles most of the heavy lifting.

SWIFT throws you onto the global stage, putting your business under a much more powerful microscope. Every international transfer is scrutinized for anti-money laundering (AML) and know-your-customer (KYC) compliance. Your payment gets cross-checked against global sanctions lists from bodies like the Office of Foreign Assets Control (OFAC).

If you accidentally transact with a sanctioned person or company, the penalties can be devastating. This puts the onus on you to thoroughly vet every international partner, adding a significant layer of risk management to every single SWIFT payment you send.

Your Top ACH and SWIFT Questions, Answered

Even with a side-by-side comparison, the real world of payments brings up specific questions right when you’re about to click “send.” Let’s tackle some of the most common ones we hear from business owners trying to make the right call between ACH and SWIFT.

Can I Use ACH for International Payments?

Straight answer? No. The ACH network you use for payroll or vendor payments is strictly for domestic bank transfers within the United States. It simply doesn't cross borders.

If you need to pay a supplier in Europe or a contractor in Asia, you’ll have to use a global system like SWIFT. You might see some services advertising "international ACH," but that's a bit of a misnomer. These are usually specialized platforms that cleverly use local payment networks in other countries, not the actual U.S. ACH system.

Which Is Better for Urgent Domestic Payments?

When a payment absolutely has to get there today within the U.S., Same-Day ACH is almost always your best bet. It delivers funds within hours and costs significantly less than a domestic wire transfer.

While a domestic wire is technically faster (often near-instant), it'll set you back $25 to $35. For most urgent business needs, like a last-minute invoice, Same-Day ACH gets the job done without the hefty price tag.

Are There Alternatives to ACH and SWIFT?

Absolutely. The world of payments is getting more crowded, and these two legacy systems are feeling the heat from newer, faster options. In the U.S., The Clearing House’s RTP network is gaining serious traction, with transaction volume nearly doubling in just two years. It's a clear signal that businesses want instant, 24/7 domestic payments.

For international transfers, fintech platforms are changing the game. They often bypass the slow and expensive correspondent banking system that SWIFT relies on, offering much better exchange rates and lower fees. You can dig deeper into the growth of real-time payment systems on fxcintel.com.

The Bottom Line: ACH and SWIFT are still the workhorses for standard bank transfers, but they aren't your only options. It's always worth checking if a newer, faster, or cheaper alternative fits your specific payment need before defaulting to a traditional wire.

How Do I Decide if a Payment Is Truly Time-Sensitive?

The key is to define what "urgent" actually means for each payment. It's not a one-size-fits-all situation.

- Routine Payroll: This is predictable and happens on a schedule. Standard ACH is perfect.

- Last-Minute Invoice: You need to avoid a late fee, but you don't need instant settlement. This is a classic use case for Same-Day ACH.

- Real Estate Closing: Here, funds must be settled irrevocably on a specific day. This level of finality and speed is exactly what a wire transfer is for.

It's all about matching the payment's urgency and value to the right network's strengths. This simple step ensures you're not paying a premium for speed you don't actually need.

Juggling payment rails and keeping the books straight can eat up a lot of your time. Bugaboo Bookkeeping offers expert, hands-off financial management tailored for Washington small businesses. We make sure your payments are handled efficiently and your books are always pristine. Learn how we can streamline your financial operations today.